To mark the 60th anniversary of its founding, BRGM organised a scientific symposium on the theme "Subsurface challenges in the 21st century". This event, which brought together partners, elected officials, the scientific community, industrialists and BRGM's supervisory ministries, featured two round table discussions on “the predictive geosciences” and “the security of mineral resource supplies” respectively.

The outlook for the subsurface – what does the future hold?

To enable as many people as possible to benefit from these discussions and get an idea of prospects for the subsurface in the coming decades, BRGM is making the entire symposium available in video form.

"Subsurface challenges in the 21st century" conference – Introduction

Transcription

Thank you again, everyone, for making yourselves available to attend this scientific event, organised to celebrate the BRGM's 60th year. It's a great opportunity to end this anniversary year in such a prestigious venue as the Collège de France. To open this symposium, without further ado, we're going to look back, in this video. It's short, but it covers the history of 60 years of the BRGM. Let's start the video. Thank you. Right... As I promised, it was a short introduction, but it sets the scene for what will follow. And I will ask Elisabeth Vergès, who is head of research and innovation strategy, to come and open the symposium from this beautiful lectern, right here. Thank you.

Thank you very much. Can you hear me? I'm head of research and innovation strategy at the French Ministry of Higher Education, Research and Innovation. I'm not suspended... Thank you for inviting me. Madam president, special advisor to the Ministry, colleagues... I stress "colleagues" because I'm a geologist, so I'm stressing that. 60 years is a long time, but it's a geological survey. So in terms of geology, frankly, 60 years is nothing. But joking apart, as you saw on the slides, the BRGM is part of something which dates back more than 60 years. And it shows to what extent knowledge of the surface, subsurface, the ground, has been, and remains still, a strategic challenge for France. Whether it's a question of resources, addressing natural risks, making new environmental services available, it's a key challenge for our country. As we saw, the BRGM was set up in 1959 with the merger of four offices: Madagascar, Algeria, French Guiana - it was a different France then - and the office in mainland France, which was the BRGGM. BRGGM isn't bad. Geological, geophysical and mining. We lost a G along the way. And recently I think the BRGM has incorporated Charbonnages de France, etc. So different services have joined together. It was only 20 years ago that the Ministry for Research became jointly responsible for the BRGM with the Ministry for the Environment and Mining. That's not long ago. I find that surprising. If you want to advance your knowledge of the surface and subsurface, you need to do research. That's what the BRGM did, and now it knows: it's a research organisation. You need to understand the processes at work, and model them in order to predict. The BRGM has a two-fold mission, as we see with its dual supervision: to advance knowledge in the areas we mentioned and answer questions of public policy. It's a public service. That isn't always an easy job, yet it's indispensable in these areas. As a national geological service, the BRGM is the key public institution in the application of earth sciences for managing resources and surface and subsurface risks, and the ministry wants it to remain as such. So geology or not, the BRGM is about the long term, as we've seen. In 1750 or 1746, - I can't remember exactly - the first geologic map was made in France by Jean-Etienne Guettard. And then in 1868, - I'm sure of the date this time - under Napoleon III, the French geologic mapping service was created. I found the decree: "The geologic map of France "will be produced at the State's expense "and a special organisation will be set up to undertake this." The BRGM took over this service 100 years later in 1968, the geologic mapping service set up by Napoleon III. It's long term, historic. This merger means the chain of production is covered from land surveys to publishing maps. The BRGM was structured on a territorial basis. In 1965, all the teams moved to Orléans, Orléans-La-Source. The policy at the time was to build towns on the outskirts... There was the CNRS campus, the university, the BRGM... That was the policy in the 1960s. The BRGM is in Orléans. That's just one anecdote. I know why it's in Orléans. Some things are surprising. It's in Orléans. Right... A network was slowly established, resulting in regional geological services in the 22 metropolitan and overseas regions. At the end of 1992, the BRGM took on, after a restructuring, the mission of scientific research and public service, adding specialist subsidiaries for commercial activities. That was a change. In 1998, it became a research institute under dual supervision. It's a research organisation, an EPIC, so a public body with commercial interests. It's a particular status because it means you are the link between research, its applications and innovation. You develop research upstream, in collaboration with the CNRS, universities, etc., top-flight research, and you are also downstream, supporting public policy and innovation. Over the course of the last two-and-a-half centuries, the challenges have changed. We weren't concerned about the sustainability of the planet and resources. We had a problem of availability. We weren't concerned about the climate, and "environment" meant what was around us. So things have changed. Today, there is a collective awareness. This collective awareness means we know. We are aware of climate change and its impact, the problem of access to resources, we know society is vulnerable to natural risks, we can't say we don't know. This collective awareness has resulted for you, for the world of geosciences, in any case, in the development of a mixed, often poor image. Geologists were seen as polluters because of mines, destroyers of countryside due to quarries, and responsible for climate change because of coal and oil. It's only recently, in the last two decades, that geosciences have had a more positive image, and geosciences are seen as a bastion against telluric, climatic and environmental risks. The BRGM has helped achieve this shift. That's very important. Knowledge of the subsurface and geological materials entails, when you understand complex mineral materials, rocks, expertise in the chemistry of recycling, for example. It's knowledge which can be transposed to other subjects. You know there's no such thing as 100% recycling, well, it won't be enough, and that the BRGM is perfectly positioned on recycling and raw material resourcing. We also know that meeting today's needs without questioning will wipe out the future for coming generations, so I want to give you a reminder. The United Nations has a roadmap for sustainable development objectives in 2050. In France, the Ministry for the Environment is leading this, but the Ministry for Research is involved and has drawn up a research roadmap to support each objective, and for when there are interactions or interfaces which conflict. For example: preserving biodiversity and feeding the planet can be tricky. And I would remind you that the scientific approach to sustainability is supported by UNESCO. In many countries, sustainability science - it's better in English, it doesn't work as well in French - is a new academic discipline which is well developed but not in France. It enables us to tackle complex, long-term global problems, climate change, change driven by man, demographics, from a wide perspective, with a holistic vision. The aim is to promote solutions and re-establish a solid relationship between humans and the environment. Fine words, I know, but these issues are relevant to us. I think the BRGM is well placed to meet this challenge, and holds all the cards to explore the discipline of sustainability science, by being the interface between academics and practitioners, the link between government, ministries, think tanks, NGOs etc. The BRGM can help to advance the field of sustainability science. On this 60th anniversary, I'd like to remind you that the ministry has strategic goals for earth sciences, in general, geosciences, coupled with environmental sciences, which is your core business, and to develop this discipline. When we're talking about these disciplines, they involve observation, since it's a natural environment. You're not working on objects in the lab but on natural objects in the field. You need to observe, take samples, collect data. Data management and modelling are key areas for our strategy, and the BRGM has a key role. 60 years after it was set up, 2019 is an important year. This year we signed the new objectives and performance contract with the scientific strategy plan, with a focus on the sites policy. That's a policy supported by all the ministries to encourage the development of strong synergies between research organisations and universities on site. That's also included in the COP. The scientific knowledge of researchers generally, researchers at the BRGM, is required in many areas. I could list these areas. They're in the objectives contract. Research on the observation and knowledge of the national and overseas subsurface, with high-level research on geological objects. Training via research, masters and PhDs, you have a role to play here, in particular, the mapping tool and multidisciplinary geosciences approach. The national scientific community having greater synergy. Collaborating and working together will not make you less visible. Working with CNRS universities will raise your visibility. And that will enable you to support each other on upstream research and applied research. Collaborations with neighbouring countries... We have a strong policy at the ministry for the solidification of Franco-German collaboration as you well know, and across Europe too, of course. I'm delighted to see that on projects such as partnerships in European geological services you're very active, in European infrastructures such as EPOS and ECCSEL, you're very active, and also in responding to programmes. H2020 is coming to an end, but we have the FP9 programme with Horizon Europe starting. The BRGM needs to get going, not only to encourage researchers to respond to calls for tenders, but so as to be well placed upstream, to influence upstream so that calls for tenders are... You understand the challenges. It's very important for us all. I hope this afternoon's symposium is food for thought. You wanted to show the new lines of research in the 21st century: the environment, artificial intelligence, subsurface usage, for example, data, resources... I would also like this symposium to be an opportunity for new collaborations between those in research. There are other organisations and academics here and the CNRS. Thanks to this synergy, the BRGM can make its contribution to knowledge in the 21st century, as we need to face up to major environmental and societal challenges. You are "a tool", in the positive sense, for the Ministry in this respect. The circumstances aren't easy, but the challenges are great, within easy reach, for geosciences in future. Some people would think that 60 is a good age for retirement. Not the BRGM. I want geosciences to reclaim their former glory. I'd like geologists to be interviewed on French television with the same respect as on American television. Geosciences need to take a stand regarding society's key environmental challenges. Thank you very much.

Thank you, Mrs Vergès. Can I ask you to now join the audience.

I'm keeping the microphone. No surprise! I just wanted to say that in my department, two sectors work with the BRGM: the environmental-sciences sector with Marie-Hélène Tusseau-Vuillemin, who couldn't be here because there's a G7 event on plastic in the environment, but Frédéric Ravel is here, and he's in charge of energy sciences, and also works with the BRGM.

Thank you for that. I will now call on our president, Michèle Rousseau, who will speak and take part, obviously, in opening this scientific symposium.

The departmental head, the representative from the ministry, former BRGM presidents and managing directors who do us the honour of joining us today, representatives of our supervising bodies, our public partners and our private partners, and members of the BRGM, thank you for being here. We're here to celebrate the BRGM's 60th. It will be 60 on the 23rd October. It's customary to say a few words about the BRGM. You've already seen the film and heard a little of the history from Elisabeth Vergès. So I'll be brief. You've seen that the foundations of the BRGM are mining, on the one hand, starting in the 18th century, and geologic mapping, and then, as often, Napoleon I, or Napoleon III who established the basis of our administrative structure. So the BRGM was officially created in 1959. It incorporated geological research and mining-exploration organisations in mainland France, Algeria, French Guiana, followed by their counterparts in French West Africa and French Equatorial Africa. That's the mining part of the BRGM. The BRGM was authorised to acquire mining rights for exploration, for exploitation, and was under the supervision of the Ministry for Industry. Then, over the next 15 years, it became more structured with regional services. It set up in Nord-Pas-de-Calais, a key mining region at the time, and then became international, with Saudi Arabia, with whom it signed a large contract. 1965, the scientific centre was set up in Orléans, and in 1968, it merged with the geologic mapping service. The BRGM is starting to resemble today's BRGM, but we're not there yet. Then we have the oil crisis. For the BRGM it's an opportunity, as crises lead to development. The oil crisis underlined France's vulnerability in terms of oil supply, and also raw materials. The government decided to carry out a mining inventory and asked the BRGM. At the same time, the BRGM developed its exploration activities internationally. It became one of the largest explorers. And then 1973 was the time when environmental awareness was starting to grow. The Ministry for the Environment was set up in 1971. In 1974, the BRGM decided to build a test site for recycling waste. It's a site we're now renovating 30 years later. The BRGM has moved with the times. Things became more difficult for the BRGM, as you saw in the film, at the start of the 1980s, throughout the 1980s. There was a global ore and metals crisis. It happens, these markets change fast. Mining projects came to an end. The BRGM then increased its research efforts in deep geology, in geothermics, and set up a geothermics public service. It then focused on commercial activities to compensate for the bad news on the mining side. It concentrated on construction, and you saw the photos of the Louvre which was being rebuilt at the time. Then came the 1990s, and the focus was again on research and public service. In 1993 and 1994, in two years, BRGM's commercial activities were transferred with the creation of two main subsidiaries: one for engineering, Antea, that was at the end of 1993, 400 BRGM staff went there, and ten years later it was privatised. Antea still exists and is doing well. And another for mining activities, La Source, which was wound up five years later. In 1998, by the decree of 1st July 1998, the BRGM became a research institution, and was placed under the dual supervision of research and industry. Then come the 2000s and the years leading up to today, where we slowly built the BRGM we have today. The BRGM continues to be a public reference institution for mining geology. Since 2009, it has been training geologists on the ground. And the BRGM kept adapting. It positioned itself as a key player in research and development in line with the new challenges, which were mostly in the areas relating to sustainable development. And to consolidate this development, in 2004, the Ministry for the Environment joined the Ministry for Research and the Ministry for Industry in a supervisory role. How does the BRGM see itself today? It has two pillars, geology on one side, digital on the other, and thanks to these pillars, it aims to respond to four challenges for society. The first is the supply of mineral resources, either from mining or recycling, and we will need both. The energy transition relies heavily on metals, and that makes France vulnerable. The BRGM thinks it's imperative to consider this, even if people are more aware of oil crises than raw material crises. Nevertheless, the issue is real. The second challenge is energy, with geothermal energy, which is an important source of renewable heat, the storage of energy and CO2. In terms of markets, CO2 storage is in its infancy, it has to be said. The BRGM thinks the price of CO2 will rise, and none of the carbon-neutral scenarios envisaged for 2050 include not storing CO2, so we are working on this issue. Third challenge: water resources, underground water. Groundwater provides - not everyone knows this - 2/3 of drinking water, 1/3 of irrigation water, replenishes river levels in summer. So given global warming, we have to adapt. Climate change will enable us, I hope, to make progress in groundwater management and underground water storage. Then we get to risks. Two types of risk for the BRGM. Natural risks: landslides, earthquakes, flooding, receding coastlines, a long-term risk which is becoming a concern for public authorities. And then exceptional events, as was the case last year, with the emergence of an underwater volcano off Mayotte. Those are natural risks. As for man-made risks, we're dealing with the legacy of former industrial and mining activities. We're doing research, but not only that. Since 2005 the BRGM has been responsible for the management of closed mines, on behalf of the state. And it's an activity which represents a quarter of our activities. The BRGM's involvement in economic activities is still strong. We've had the Carnot label for all our activities since 2006. Two years ago we set up a process for supporting innovation, and I hope the BRGM will set up more small, targeted subsidiaries. The BRGM has subsidiaries: - we haven't mentioned them - CFG is specialized in geothermal energy and IRIS in geophysics instrumentation. We haven't set up a subsidiary for 20 years. The subsidiaries we're planning are different to those of the past. The previous subsidiaries were parts of the BRGM. What we're looking to do is to create an activity ex nihilo in synergy with the BRGM, but without the BRGM losing any parts of itself. So to summarise this part, the current BRGM is very similar to the BRGM of the early 2020s, in France and internationally. International projects represent around 15% of our contract and agreements activity. What does the future hold? I agree with Elisabeth Vergès that the BRGM has a long future ahead. The BRGM is a robust institution. Today, we have a thousand people in Orléans and throughout the regions and overseas. We are 45% women, 55% men, which is quite a good balance, and the average age is 43. It's an institution which doesn't have... any glaring shortcoming in these numbers. It's the national geological service, and it's closely linked to other geological services in Europe and internationally. It has two characteristics. First, we remain specialised. Some institutions say they can do everything. The BRGM doesn't say that. The BRGM is committed to subsurface sciences, in all aspects, but it remains focused on subsurface sciences. Second characteristic, the BRGM balances its budget, at least for now, with 50% subsidies and 50% contracts and agreements, except for the closed mines which are financed by the state. These contracts and agreements stem from a range of clients and subjects. It doesn't mean the BRGM won't have problems of demand, but given the range of clients and subjects, I think it's protected from serious, sudden shock in one year. And I'd like to say that the BRGM has found the resources to renovate its testing sites and laboratories. The largest investment programme for 30 years is underway, and I think that gives us advantages for the future. The BRGM is robust, but the BRGM has to continue to move with the times. There are two revolutions happening: the climate revolution - the BRGM must contribute to the solutions - and the digital revolution. Everything is becoming digital and interconnected, and the BRGM must embrace this change. Of course it's doing that, but we have to go even further in this direction. Those are the two revolutions most often mentioned. I think there is a third one emerging, the societal revolution. Citizens' view of science is changing. The Ministry for Research promotes open science. Our data is completely free. Social media is shaking up the governance of companies and challenging the "experts", of which BRGM is one. The BRGM must adapt to that. We have started discussing it, but we need to consider it further. I think the BRGM has a bright future. And the two round tables we're going to have, as I've now finished, will be an opportunity to illustrate that. Thank you for your attention.

Predictive geosciences: towards new services based on subsurface data

Transcription

Now we've had the introductions and opening speeches to our 60-year anniversary symposium, I'll ask the speakers for the first round table, the subject of which you can see on the screen, Predictive Geosciences: Towards New Services Based on Subsurface Data, to come up and take their places. This first round table will be chaired by Benoît Tonson, who is kind enough to lead this round table. Benoît Tonson represents a journal called The Conversation, in which the BRGM is a partner, and he writes the science and technology column. Benoît, I'll let you introduce this first round table.

Thank you very much. Welcome to this first round table headed "Predictive Geosciences: "Towards New Services Based on Subsurface Data." I'm Benoît Tonson, science journalist for The Conversation, and I'm delighted to lead this debate. We have a great panel representing all the subsurface stakeholders: academics, industrialists and government representatives. I'll introduce them in alphabetical order. We have John Ludden, professor of environmental governance at Edinburgh's Heriot-Watt University. He was formerly director of the British Geological Survey and deputy director for earth sciences at CNRS. Hello. We have Dominique Janodet, research and development director of Total Exploration and Production. Welcome. Frédéric Plas, research and development director at Andra. Martin Peersman, head of subsurface programmes at the Ministry of the Interior in the Netherlands. Just one point. Martin will speak in English and be translated. We are also delighted to welcome Bernard Tardieu, co-president of the energy commission at the Académie des technologies, and honorary president at Coyne et Bellier Tractebel. And then François Robida, director of the programme Digital data, services and infrastructure at the BRGM. Welcome everyone. I'll say a few words to define the question then hand over to the interesting people, namely our specialists. So what are predictive geosciences? It's combining geosciences and digital sciences in order to predict subsurface behaviour. The technological boom we've seen over the last few decades enables us to increase our processing capacity and hence modelling. Algorithms which are increasingly sophisticated and demanding in processing power can now be used. Dominique Janodet can tell us about 3-D subsurface digitisation techniques developed by Total. Prediction also means managing risks, be that in the field of civil engineering, which Bernard Tardieu knows well, or longer term, with the storage of nuclear waste, as Frédéric Plas will explain. Understanding, modelling, and predicting enables political decisions to be made. Should we build a metro here, pump out the water, or leave the subsurface alone? To make these decisions, politicians can rely on experts from national agencies and research centres. We can review what's happening in France and abroad with François Robida from the BRGM, John Ludden, who works in Great Britain, and Martin Peersman, in the Netherlands. When we talk about key political decisions to be made, climate change comes to mind. What is the role of the subsurface in energy transition? John Ludden will talk about that. Finally, digital tools mean data. What type of data can we use? The same as before digital? Is it just how we process that data that's changing, or can we get new data? Should we share the data or keep it to ourselves? These are all subjects we can address during our discussion, which will be concluded by Bernard Cabaret, our key speaker for this round table, who was president of the BRGM from 1997 to 2003. To start off this round table, I'll hand over to François Robida, with the question "Why does the subject of predictive geosciences "interest the BRGM and also "academic and industrial actors in this field?"

Thank you, Benoît. Good afternoon, everyone. I think it was touched on by Elisabeth Vergès and Michèle Rousseau, the BRGM, as a national geological service, has had a mission relating to subsurface data since its creation. As part of its mission, it was set up to collect data, format it and reproduce it. We've been reminded of that today, as it happens. It has been the case for many years, but now it's been made very clear. If we go back a bit, and today is a chance to do that, back into the past, in the 1960s we started to build our first databases. But the preoccupation with predictivity and developing tools and methods was already there. The BRGM was the birthplace, in a way, of the discipline of geostatistics with Georges Matheron, who then went to the Ecole des Mines to continue with his research, but it started at the BRGM. And then very rapidly, with the accumulation of data, of knowledge especially in the field of mining, how to achieve mining predictivity and develop methods. The publishing side has a long history with, for those who remember, 3615 BRGM, which was a way of accessing BRGM data on Minitel, but all above board. In 1998, the launch of the InfoTerre site, which gave, being fully interactive... it gave access to the BSS, the subsurface database, today that's 800,000 drilling sites, the geological map and data from other databases relating to risks, water, geophysics, etc. There was a change of direction, I think, in the early 2000s, under the presidency of Mr Cabaret and driven by Yves Caristan with a project called Terre virtuelle. The aim of trying to identify... It was the realisation that digital was a key pillar if you wanted to make use of subsurface data. Out of the Terre virtuelle project came a number of key elements that we see today relating to data management, interoperability, which is commonplace today but which was difficult to discuss at the time, and the willingness to say that geology and subsurface data wasn't just for geologists, but could be used by others for various uses and applications. That implied interoperability, being able to work together. We worked on that, on standardisation to enable this dialogue, the opening of distributed systems that we'd developed with British colleagues. We manage a portal called OneGeology, which regroups 120 countries, for publishing geological map data. It's thanks to technical advances and the strong partnership we have with the BGS that we can do this worldwide. So a distribution architecture heavily based on what we call web services. Today, 100 times a second, 24/24, 365 days a year, there's a request to our servers for cartographic information. That gives you an idea of the scale of access to the data, way beyond the traditional visits to the library or other centres, which still exist. Today, and this has been mentioned, open data, open science, it isn't just a question of opening the data but also the tools to produce research, to be able to undertake reproducibility of research, these are key challenges. That means going further in the semantic description of our concepts, being sure that what we call by one word is understood by the other person. OK. Beyond that, today, there's an increase in data coming not only from the BRGM but from the academic world, industry and citizens on a number of subjects. So we need to be the link between these worlds, all the stakeholders who produce data with different types of sensors, so very different specifications, and we put it all on the platforms. It's a commonly used term in digital technology but it must take on meaning in our world. Will the platforms include industrialists, academics, and be available to all? Will there be platforms for each sector? We don't know. It's one of the questions we're asking, and to which we hope to have some answers from our panel today. To exploit it all, we have at our disposition all manner of tools, artificial intelligence, big data, which we need to use to produce predictivity, as we have been doing, without knowing it, for several years. I think this will be tackled by our speakers. The term digital twin: how can we reproduce the functioning of equipment and couple it with the subsurface? These are matters of interest to the BRGM in order to know how to position ourselves as the national geological service in the future, what data, which partners, to produce which types of services.

Thank you. I'll now go over to Bernard Tardieu, who has a lot of experience in the civil engineering field. Since when has the subject of predictive geosciences been of interest to industry? And finally, how did it develop from academic expertise to an industrial application?

Firstly, thank you for inviting me. It's very kind. There's a long tradition of research in France. You've all heard of Caquot and Cohen. The difference being Cohen exported, which wasn't the case for Caquot. But for a certain time, I discovered as a young engineer, in France we weren't very good at soil mechanics, and during the time of Serre-Ponçon, Cohen brought over three American experts. Rock mechanics started after the Malpasset accident. In both cases, we realise it was the understanding of water in a structure which wasn't strong in France, understanding that water isn't an external force but a state variable. The Ministry for Research, or in charge of research, - the name changed - understood that, because at the end of the 1980s, in 1989, there was a series of research programmes. There was a geomaterials GRECO, a PROGEC, a CORGEC of which I was vice-president, etc. Technological advances. The Ministry for Research really got its hands and feet dirty in order to develop knowledge in universities, in schools, and there were strong interconnections. You're going to say: "So what?" That's a harsh question. In practice, the result of these people learning through research was that they were hired, they went to work for companies, in design offices or for contracting authorities, and they arrived with their baggage, with this science. And that innervated the whole process and contractors for a long time. Internationally, we made ourselves heard in those fields, but the level didn't rise for 20 or 30 years because the large international research centres, which were in the US and Europe, were less interested in large dams and what was underground. Nevertheless, achievements were made. So I'm very grateful to the Ministry for Research for helping our profession for over 20 years. And it continued. I know a lot of things were paid for by Andra, but Cigéo was a direct heir of CORGEC, PROGEC and GRECO.

I think you have some examples of digital twins.

I'd like to go back to... My neighbour mentioned digital twins. A subject close to my heart. Back in 1997, we wrote, with Odile Ozanam, an excellent colleague who is now at Andra, a book on this subject. Why do digital twins matter in our field? Simply because in large civil-engineering or underground projects, we don't know the rheological laws, we don't know the parameters, we just know the behaviours are complex. So we make our calculations and then we construct the dam, etc., we are only reproducing the data we found in the literature without learning anything. With a digital twin, we can say: "I'll make a model." This was in 1997, we couldn't do what we can today. But you make a model and represent the construction digitally, either in layers for a dam, or, for a tunnel, by digging, etc. You add the water filling, the loading, the consolidation, the creep, the earthquakes, and each time, you compare it to the measurements, since the digital twin doesn't add much because it's combined with high-quality measurements. The only real progress comes from physical measurements, as everyone knows. And so you take these measurements, you choose the places, you measure the movement, the pressure, static or dynamic, and then you monitor it. But there's something you need to understand. You don't take a simplistic model and change the parameters at each stage because there's no point. You don't learn anything, except that it isn't elastic, which is easy. And so you have to say: "I'm making a model where rheological law "is such that it will follow "unrefined, static and dynamic phenomena. "And once I've defined this model, "I'll have a real digital twin "which will enable me to monitor and improve my prediction "over the life of the project." Can I give two examples?

Please do.

I won't take too long. The first is the Infiernillo dam in Mexico. It was constructed between 1960 and 1963, which was quick for a 150-metre high dam, and filled in 1964. There was an earthquake in 1979, then a series and a large one in 1985. And in Mexico, a lot of measurements were taken. So that enabled... They were monitored, including during the earthquakes. The digital twin represents the construction of the dam, consolidation in the core, filling the dam, the first earthquake. Measurements are taken each time. So when you get to the end of the dam's construction of course, you're at the top and the compaction is measured in the centre. There was a metre of compaction. Then we look at the first earthquake. You have 20cm plus 4cm offset. And gradually, you figure out the model, always the same, with strain hardening, coupled with the water as state variable. And at the end, you say: "Perhaps based on this, "I can predict "the effect of a major earthquake "on this dam since I understand how it works." We can't prove it, because we haven't had a major earthquake. Well... You never know. The second was a copper mine in El Teniente, in Chile. A copper mine which is 1,000 metres deep. We're in a subduction zone. I'm talking to geologists... And there are caving levels, production levels, ventilation levels, transport levels. As a result of the mining, you end up with zones filled with material. And so, the stresses are spread all around, the shearing increases all around. As you are already at the limit, in a subduction zone, you get rock bursts and you bring down the transport galleries and put people in danger. So you represent... We didn't have the resources we have today, and which I would have loved. You only represent these transport galleries and you send out waves, and look at the results on both the roof anchoring and roof collapse, and also the rise in the floor. You don't generally measure the floor, but here we did. This led to a better understanding of the effect of rock bursts and how to change the anchoring, improve the anchoring, put anchoring on the face and on the floor to make better predictions for the future. So the idea of a digital twin is to continually learn in order to predict.

Thank you. We're now going to move to a different scale with Frédéric Plas from Andra. We were looking at civil-engineering projects, so "short-term" modelling, but at Andra, you're working on very long-term modelling. You're trying to predict subsurface changes over millions of years. So a simple question: How do you work and manage risks on such long-term scales?

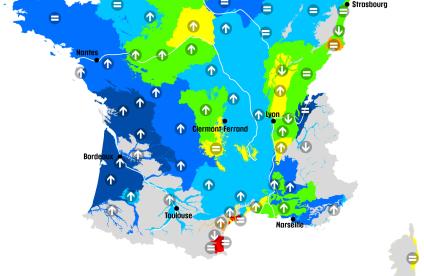

Thank you. Hello to everyone, and hello colleagues. My background is geosciences, so I'm one of you. We're often asked: "How do you do it?" Because the Cigéo project is the industrial centre for storing the most dangerous radioactive waste. We're talking about high-level waste; For the experts, that's several billion becquerels per gram, and then we have intermediate-level waste. We're dealing with radioactivity which could last for millions of years. Iodine 129 and chlorine 36, we're talking 15, 20 million years. The objective with this radioactive waste, which is present on French soil, is to protect humans and the environment. And the solution which has been chosen is geological storage. The aim is to store the most dangerous waste far away from the surface of the biosphere for as long as possible, until the radioactivity has sufficiently decreased. And given the periods of activity, we're looking at millions of years. That's a long time to a person, but not to a geologist, but it is a long timescale. In this respect, geology is the cornerstone of safety. I'll digress and say this concept was initially the idea of geologists, of a great geologist called Jean Goguel in the early 1980s. Geologists came up with the concept because they have a notion of time, and time is extremely important in geology. It's almost the science of time. And so geologists came up with the concept of geological storage. I'll give some context before describing how it's done, in five minutes. The thing we're discussing is situated in the east of the Paris Basin, a well-known area, relatively simple. It's 500 metres deep, at the height of the Jurassic. The layer which interests us is the Callovo-Oxfordian, a layer of clay at 500m deep. For geologists, the Callovo-Oxfordian doesn't exist. It's an invention. At Andra, we know of the Oxfordian, the Callovian but not the Callovo-Oxfordian. Andra invented the term. The thing which interests us is very small. You can see it in red. It's 35km2 at 500 metres deep. If you could...

There.

No, the one before. The object that concerns us, on which we need to focus over a million years, is a little postage stamp, the bit in red, approximately 35km2. It's a block of 35km2 with a storage situated at a depth of 500 metres. Historically, you have in blue the slightly wider zone of 230km2 on which we've established the feasibility of the storage. This choice was the result of a long process, both scientific and political, to which the BRGM greatly contributed when it came to selecting various sites and finding candidates that would agree to having a laboratory and then storage. So what we need to do is to look at an object that is multi. Go to the next slide... We need to manage an object that has multiple components. We have packets of waste as far as the geological field which is itself multi-layered. We need to manage multiple materials. We have geomaterials, rock, but also worked materials: glass, concrete, steel. We need to manage multi-level spatial objects. Some measure hundreds of metres, and in the geological field, that can rise to several tens or even hundreds of kilometres. We also have to manage multi-physical objects, since this kind of storage brings into play, in storage and in the geological field, thermic, hydraulic, mechanical and geochemical elements. Ultimately, what interests us is the transfer of radionuclides. Finally, a multi-level timescale. We're talking millions of years, but we also have to manage the exploitation phase that lasts around 100 years. All of this requires, and this is something we've practised for 20 years, a great deal of integration, so a way of working not confined to silos, but one in which all of those multiple factors can converge with a wide range of tools. It's above all a multi-disciplinary integration. We don't see geology on its own: you can't see geomechanics without seeing geochemistry, geochemistry without hydrogeology, hydrogeology without geomechanics. So it requires not only a lot of work to define each of those disciplines, but also the ability to bring together all of the disciplines in such a way that a geomechanic can talk to a geochemist, a geochemist to a hydrogeologist, and so as to have a very integrated vision of that geological object. An additional complexity is that geological storage adds a good many constraints and demands. Finally, life does not end in the soil. We must also look at the subsurface and the surface. We need to include other disciplines such as climate change, as well as internal and external geodynamic evolutions. So a big lesson from those 20 years of developing the Cigéo project, is the necessity of bringing together all the disciplines in order to build an object that has global consistency, is multi-layered, multi-physical and multi-material. It's also a multi-level spatial integration. It's a large object, but understanding it requires the inclusion of levels that are very different. It's a task involving definition, consistency, and permanent upscaling or downscaling that will enable us to go from extremely small levels of understanding the fundamental processes through, for example, molecular dynamics, to levels of several hundred square kilometres, which is the level where the major geological and geodynamic processes occur. And there is also the need to ensure multi-layer integration takes place. Geological storage is situated on a metric scale of several tens of kilometres. This is the way in which we put back into perspective all of the processes and that we are capable, basically, of providing a consistent scale in time and space for the processes that will take place. The last point. Definition is one thing, but we need tools for integration. I said tools in the plural, so I'll mention two. They're not unique, we already spoke about them. Of course, all these data-management and knowledge-acquisition tools are extremely important, but we have two fundamental tools to ensure this. First, geological modelling and geomodellers which will aggregate multiple knowledge. Here, we just have a geometric representation, but in reality geomodellers can now provide a representation of the physicochemical properties of the geological environment on various scales which are relevant to the problem. On the other hand, we have everything that is being done in terms of BIM and the development of digital models. It's quite common in the aerospace industry. It's newer in the nuclear industry and in geological storage, and it's the convergence both of this geological modelling and this digital model. Today we're bringing into play, via these digital twins... In a digital twin, we don't look for all the information that comes from a digital model. It contains very detailed information which we can interpret. That digital twin can then be processed by high-performance digital simulation tools. As we have said, progress in digital simulation, and some large organisations in France, and in particular Andra, enable us today to run digital simulations on multi-level timescales, with multiple components and with levels of precision and representation that are quite remarkable. I'll finish on this: should we base storage safety on digital simulation? I'm going to take the opposite view to my last slide. Actually, no. I believe we need to remain extremely careful. There will always be uncertainties. Life is full of uncertainties. Science is full of uncertainties. Obviously, we're not basing safe storage on digital simulation. Digital simulation is an extremely powerful tool for aggregating knowledge, but we must remain extremely cautious. Maybe that's the geologist's vision, and the geoscience specialist's vision is important to keep our feet on the ground, especially if we launch ourselves into a timescale of a million years. And I'll take just one example which is the French approach, a deterministic approach which sets us apart from what is being done by some of our colleagues abroad, particularly in the English-speaking world. The Paris Basin is known for being an "aseismic" zone. But who can say that, during the next million years, that there won't be any earthquakes? We tend to say that any event, however unlikely, is considered certain, and so we take it into account in our safety scenarios. You can't reject an event, however unlikely. So even if digital simulation is a very powerful tool, we also aggregate purely qualitative knowledge with the common sense of geosciences, which enables us to identify uncertainties and events that digital simulation won't necessarily predict, but simply provide the consequences. And it's on this combined input of qualitative knowledge, digital knowledge and common sense in our approach to uncertainties and the fact of considering that even unlikely events can be considered as certain that we can project over a million-year timescale, thanks in particular to the progress that has been made both in all the geoscience tools and in today's digital tools known as BIM and all the digital-simulation tools. Thank you.

Thank you. We'll stay on the modelling of the subsurface, but with different objectives with Dominique Janodet. At Total, in your R&D department, you try to model the subsurface in 3-D. The downside of this approach is that the algorithms require a lot of computing power. How have you managed this problem at Total?

Maybe I'll come back to the role of geosciences in the oil industry because they are basically the starting point for our entire business. At the start, prospectors like Colonel Drake were looking for clues on the surface. But when we realised that oil, its genesis, its trapping was linked to geological phenomena, geologists became involved, and have been ever since. They're still here and are looking to progress, because we can never be totally predictive, as we would like to be. The industry is still drilling a lot of dry wells. You could say that's part of the game, and that it's all about assessing the issues, the risks and the associated costs. But the approach is still much the same. It's understanding geological phenomena, for example by observing the terrain There is a very nice reef, an outcrop in the first image on my slide. Secondly, trying to find those elements in the subsurface. A reef can be an excellent reservoir for trapping oil or gas. We have found an extremely powerful way to try to understand the architecture of the subsurface, and that's seismic reflection. It started quite a few years ago. At first it was quite crude. The images weren't necessarily very interpretable. We were looking for bumps, anticlinal forms that can reveal oil trapping. And then we started to acquire more and more data by seismic reflection. And we started to process it in a more sophisticated way. Because where the land is more or less flat, as in the Paris Basin, we were quite easily able to obtain images. But where you have salt domes, a slightly complex subsurface or overlapping areas, it became extremely difficult. So the industry has continued to acquire more and more data, in particular by seismic reflection, and process it in an increasingly thorough way. So we knew a number of algorithms, in-depth migrations, for those who know the subject. We still had a lot of difficulty putting them to use, because we didn't have the processing power that allowed it to be done. Since the 1980s, there have been great scientists, like Professor Berkhout in the Netherlands, who developed the theory of depth migration, but we really needed computing power for that. At the same time, we started to acquire large quantities of 3-D seismic data. We quickly filled up all the existing hard drives. We quickly used up all the existing IT capacity. So we've kept on progressing. At Total, we've continued to put in place increasingly powerful resources to process this seismic data. In Pau, we recently inaugurated a large supercomputer called Pangea III, which gives us a processing capacity over 30 petaFLOPS. So 10 to the power of 15 may be a little theoretical. It's the computing power of 170,000 personal computers, so it amounts to quite a powerful thing. We're still thinking about what we need to do in the future to best process our seismic data, as we continue to acquire increasingly rich data. We're no longer satisfied with P waves, we want to use S waves. Now we're doing seismic repetition. So that's more and more data that must be processed. Maybe we'll have a Pangea IV, again with more computing power. Or maybe the next step will be to use the cloud to process those huge amounts of data with tools that will be available, that will be made available to us, perhaps by large digital groups. Then we have to interpret all this data. You can imagine how long it would take to do by hand. It wasn't so long ago, when I started my career, well, it's a little while ago, when we interpreted seismic activity on paper. I imagine that a number of you, faced with this kind of subject, have done so too. When you have a 3-D seismic area covering thousands of square kilometres, interpreting it by hand is rather time consuming. I don't know how many decades it would take. So we also looked for interpretation tools that would allow us to go faster and faster, with automatic interpretation tools. And now we're looking for the next step, and that is artificial intelligence. At Total, we set up a partnership with Google to try to put in place machine-learning systems that will allow us to accelerate the interpretation process. It may be that 90% of the interpretation of a 3-D seismic block will be done with this machine-learning algorithm. We will always need a little natural intelligence over and above artificial intelligence. Because there will always be choices to be made in terms of interpreting our seismic data, to find out where the roof is at such a depth, to know where there might be an evolution of facies in a reservoir. But we'll be able to go faster and faster thanks to all of these tools. Then, once we have drilled a geological object that we think is potentially a deposit, having found it, geosciences' work does not stop there, because the object has to be evaluated. What's there, how much gas or oil is there in the structure? Where to locate other wells to better assess it? And the work continues, once we've evaluated the field, on how it will behave. How is the fluid going to come out? At what level of production? Are we expecting 20,000 barrels or 1,000 barrels a day? How will the water rise in the system? So there again, we're expecting geosciences to be predictive. And again, it's digital technology that helps us, because we're going to model our field with finite elements. We'll try to model, to simulate fluid flows through the reservoir. So we've been using digital models for quite a few years. I won't call them twins, because there is always that component of uncertainty which was described previously and that we must take into account. But we are trying to model increasingly complex phenomena. For example we're now looking to pair geomechanics and the fluid-flow simulation. It's something we haven't yet done, but have come close to. Now for example, in research, we're working on simulators that could use both mechanisms, both components. That might bring us much closer to real subsurface-behaviour simulation. So again, we need computing power, because when you combine geomechanics and fluid displacement, you need to multiply your computing power by a factor of maybe 10 or 20. And then, to open up the debate a little, Mrs Rousseau mentioned the CCS, a subject which interests us. When we eventually inject CO2 in the subsurface, we'll also have to be able to model what is happening. From a thermodynamic point of view, for example when injecting CO2 in liquid form in a depleted field, there are a number of topics to look at. How will the reservoir behave, when it has produced hydrocarbons and perhaps settled a bit, when you inject CO2 at a high flow rate? Well, that is also an issue for geosciences. And there again, we'll need to be able to simulate phenomena in the subsurface. I'd say that geosciences still have a great future in our industry. To meet current challenges in the production of hydrocarbons, oil, gas, to better understand the fields, but perhaps also in the context of CCS, to understand how we'll manage to trap CO2. And in that case, the time component will not be quite the same, because we exploit the deposit for 20, 30 years, and once we inject CO2 into the subsurface, we'll also have to be able to predict, over a longer period of time, how the whole thing will remain stable and the CO2 will not rise. Here again, we have issues, and I think that geosciences still have a big role to play in all of these areas.

Thank you. I'll now open this round table internationally with Martin Peersman, who will tell us how the Netherlands manage their subsurface, and will also talk about digital twins.

Thanks a lot. Thank you very much, and thanks for the translation. To conclude this round table, we're going to move to an even more international, global level. So John Ludden, we're going to speak to you about the environment. What role does the subsurface play in the energy transition, for you?

Thank you and congratulations to the BRGM. Speaking last and seeing everything that has already been said... Sometimes we can leave a message. So I asked Pierre what I should say. He told me to shake the coconut tree. So I'll try to do that. I have worked, as you have perhaps seen, in the academic sector. I was research director at the CNRS and I led the BGS. I believe that there is mistrust between basic research and applied research. It still exists, and I believe that coming together is fundamental for geosciences. I believe there is a kind of misunderstanding between the more environmental and climate sectors, and the part devoted to earth sciences, the planet. So what can we do? I would say that the earth sciences as we have known them, are over, I'm convinced of that. I look at the people here, you are basically... I don't see a lot of people from the millennial generation. There aren't many. At the BGS, we were lucky enough to be able to rejuvenate the scientific population. I had 200 geologists of that generation. And we asked the question when implementing the strategy that we have just overhauled. There is a new female director of the BGS who's taking it on. And the question... The number one problem that people wanted to solve was decarbonisation of the planet. We can say that we geologists, especially us in Great Britain, created the industrial revolution. We started putting carbon into the system, and it's up to geologists to try to remove it. I think we have a role to play in this area. But obviously, it's not up to us alone. We must share the work between researchers who are doing the cutting-edge research that is necessary, and the application of these problems. And in earth sciences, if we look at medicine, if we look at the science of medicine, doctors say: "There's a problem, this person is ill. "What are we going to do? "We'll find a solution for this sick person." We in earth sciences, not only surveys but geosciences in general, tend to say: "The planet is sick, the planet is sick." But they haven't said yet what they will do to solve this problem. And it's obvious that the cure requires geology combined with social sciences, with engineering sciences and all the other sciences. So... I think it will be very difficult in the future for earth-science teachers to teach as we did before. In England it's seen increasingly as a dirty science, and we have more and more difficult interventions. Last week I was at the Scottish Oil Club, and it was difficult to speak. There were people asking questions: "Why are you still sucking oil? "Why are you doing it?" So we need to change our dialogue, we need to change the message. We have the possibility to do it because we have a revolution in the discipline, as you have just seen, with the arrival of new technology, the high-sensitivity sensors, visualisation, modelling, digital twins, things like that. So we have the possibility of doing that. You've seen... in Holland, the Netherlands, they've pushed modelling and the concept of digital twins. Those are not necessarily the things to do in every country. In England, that part will probably be done by part of the government called the Geospatial Commission which plays that role. In my opinion, for us and perhaps for the BRGM, there is always an R in the BRGM, there is research, but upstream research, trying to set up the solutions. And I'll give you a few examples of this. Obviously, there is decontamination for radioactive waste, geothermic, carbon capture and storage, etc. But looking towards Total, you are absolutely right, you have to understand how fluids migrate, you have to be able to model them, you have to be able to... master all that. But in Europe, there is no natural laboratory to do it. We talked here about setting up a laboratory where we could really start to do that kind of study, to understand CO2 capture and all that. So why not have a few big earth-science projects that go from basic research to applied research? We even have innovations with that. And I'll give you three examples. An underground technological laboratory, a bit like Andra, but for other things. I have a personal project, but it has become an international project, to drill in a magmatic field in Iceland and to understand how magma works for several reasons. These are high-value earth-science projects which are very visible. And coming back to the data... Obviously, the BRGM and the BGS, in the data discipline in Europe, we lead the research part. And a long time ago I led a project, EPOS, the European Plate Observing System. It's a big European project now, but I had trouble selling the idea to the survey. They found it too difficult. But in fact, it's a project that serves as a database for earth sciences in Europe. At the moment, the BGS and the BRGM do this together, with the help of other surveys too. Regarding the research part now, three years ago, I started a second project called The Ultimate Earth Project concerning future emerging technologies, to look at what can be modelled and what can be measured on Earth. Obviously it had to be done. I had a hard time selling it at the European level. But in parallel, climatologists set up a project and we got together, earth sciences and climatologists, to try and push a project called ExtremeEarth which, so far, has not succeeded. But I think the concept is very good. The idea of ExtremeEarth is that if the climatologists wanted to carry out more or less kilometric modelling of the climate and its applications, they need very advanced algorithms for that, obviously. And they asked us: "What can you do that's as good as that?" We said: "We can do things in seismology. "We can do vibration modelling", which is as advanced as what they wanted to do in climatology. So the idea was to create a project using high-performance computing for climatologists, high-performance computing for earth sciences, and we have edge computing which are the applications that we create with these high-performance computers. That is, vegetation modelling, subsurface modelling, etc. So the message, basically, is that I believe that earth sciences as we know them are over. I think that... I wonder if we should teach petrology in a university. But on the other hand, Elon Musk will soon land something on the moon. We will always need petrologists for that. So there is this question where do we start and what do we stop. I think there is a role for moon surveys too. Because obviously, if we ever live on other planets, on the moon or on Mars, there will be geoengineering behind that. It's a role for us, we mustn't forget that. So basically, where are we going now? We have to rethink what we're teaching in earth sciences. We have to make sure that surveys collaborate as they should with research institutes and universities. In France, it's not bad, you're doing well, quite well. In England we're doing better. But in other countries, it's hardly done, so we really have to do that. We have to start speaking the same language as the climatologists, the environmentalists and those who study the ecosystem to set up a model of the Earth which is not only... the superficial envelopes of the Earth, but which is the Earth and the superficial envelopes. A few years ago, I see someone in the room who knows this very well, when the European Research Council was established, the Earth System Science group had no geologists at the start. Someone called me and said: "There's a problem." So we found three geologists. But at one point there was a kind of concept, an idea that for the Earth system, you don't need to do geology because the system isn't fast enough, etc. It has changed, but there you go. That's my message. Thank you.

Thank you very much. We have about ten minutes left before Mr Cabaret concludes this first round table. We may have time to take questions from the audience, if anyone has a question for one of our speakers.

So there you are, if you have questions in the audience, now is the time to ask them. Unless everything has been said so clearly and precisely that all the questions have been answered. Ah, Yves Le Bars.

I don't know if the microphone is working.

Yes, it is.

Yves Le Bars, yes. It's a question for our Dutch friend. I heard that since the Middle Ages, the soil in the Netherlands had dropped by 2m. It was a Dutch specialist in hydraulic systems who told us that at a conference of the French Association for Natural Disaster Risk Reduction that I attended. It didn't appear in the presentation, where geology gave it a timescale of a thousand years. Is that true?

Another question. If you could introduce yourself...

Hello. I am the director of the Foundation for Research on Biodiversity, of which the BRGM is one of the founding members. I have a question. Several issues were discussed, but it seems to me that one issue that has not been discussed is that of biodiversity and its erosion. I wanted to know what is your understanding of the challenges of biodiversity, mainly soil biodiversity of the subsurface and the interactions that there may be between the different environments, since we know very well, for example, that if the soil of the Netherlands dropped by 2m, it's also due to biological processes: oxidation, mineralisation of organic matter. So I think we have to take all that into account. I wanted to know how you, in your prediction processes, take into account living matter, not only for impact that you might have on living matter, but also the retrospective effect that living matter could have on infrastructure, etc.

Who would like to answer?

I'll start. The question was asked to Martin Peersman for the Netherlands. Yes, absolutely. I didn't talk about it, but the BGS and the surveys in general are often involved in critical zone observatories. These are regions where we try to understand the interaction on the surface, etc. So we in Great Britain have set up two observatories for the energy of the future. Our Glasgow observatory looks at low-temperature geothermal energy in the city. At the same time, we set up a laboratory associated with that. So we're looking at the soils, the biology, the base line. We try to take, like they did for Andra, one cubic kilometre of rock and understand it thoroughly. My idea is that we don't understand those things as fully as we should. That's why we need modelling, but we also need laboratories to test the models. And then remediation systems to resolve the problems.

Maybe I can add a comment also for the industrial part. I was in the Netherlands, so I experienced what was said about decommissioning. Our rigs are near the end of their lives. It is a subject that we're looking at very closely. I would also say, more generally, that we are trying to minimise the impact of our activities on the surroundings and on the environment. For example, when we talk about seismic acquisition to get data from the subsurface, we're developing techniques that are less and less impactful. For example, in areas of dense forest, we're studying the possibility of seismic acquisition with drones that are hung under airships. You drop biodegradable sensors. So no need to send people to the forest to lay trails. We're developing techniques that are less and less impactful. And at sea, we're looking at the marine vibrator, something that would probably be less disturbing for the wildlife than the air guns that we use. So I think really, our focus is to reduce as much as possible our environmental footprint and the impact that we have on the environment that we're working in.

It's working. Thank you very much for that round table. Mr Peersman.

OK. There is no doubt that companies are responsible for restoring sites. And what we call decommissioning, that is to say plug the wells which have been exploited, whether on land or at sea, is totally the responsibility of the oil operators. We get a sense of the size of this task in the Netherlands, where the whole industry set up a collaborative platform dedicated to the subject, called Next Step, also under the aegis of the national company, which is called EBN, and the Ministry of Economic Affairs. Plugging a well means making sure nothing leaks out over the coming decades. That means finding the right technologies, the correct way of doing it and subsequent monitoring of the plugged wells. It's a fairly new subject because... Few sites have been decommissioned. They were still in production. In the Netherlands, to give you an idea, there are around 150 platforms producing offshore. Maybe four or five have been decommissioned. But between 2025 and 2030, more than half those platforms are due to be abandoned. So it's a subject the industry takes seriously, with the help of the contractors and of the regulators, since all this is subject to regulations that are very precisely defined. There is the mines inspectorate known as the SODM in the Netherlands, which is tasked with working with the industry to see that it is done under the best conditions and that there is no risk of leakage later. In the past, some abandoned wells may have been insufficiently plugged. I know of a few cases that happened, actually. It's also a matter of sharing information. Correct me if I'm wrong, but in one case, the well wasn't properly referenced, wasn't really visible on the cadastral plan and construction took place nearby. So there is also a responsibility throughout the industry to share information on sites, on what has been done with communities and local authorities.

A quick change of microphone. Thank you everyone. Mr Plas, a word?

Just a word about the problems of plugging. Stored waste has to be plugged. It's designed for that. We've been working for a long time on how to plug a hole in a geological environment. We're more than willing to share information because we have to guarantee that the wells that we dig won't end up being return ducts for radionuclides but also for fluids, water and gas. So closing up those sites is something we've worked on for 20 or 30 years. We have done lots of experiments, though obviously not in the conditions of a very deep oil reservoir, but it's a predictable subject because we're basing it on a timescale of a million years, or even forever in the case of an oil reservoir. It brings into play various disciplines in the field of geosciences, and it's a real subject. Absolutely. And as I said, CO2 and CCS is also a subject, because the CO2 that is reinjected into the subsurface must stay there.

Right. Thank you everyone for that round table. Let's give a round of applause for those interesting contributions. I would ask you to stay where you are, as this round table, like the next one, will end with a keynote speech. Our speaker is Bernard Cabaret, former president of the BRGM in the late 1990s and the early 2000s, a key period if ever there was one. I'll invite Bernard Cabaret onto the stage and to take the podium to say a few words about the vision and historical perspective that his view brings us, because the BRGM is 60 years old. Over this time, it has evolved and adapted to changes and to societal issues that have come along and taken shape. Bernard Cabaret will talk about that. Bernard Cabaret.

It's amazing to me to be speaking to you, as I was not forewarned of the role I would be taking on, but I'm taking it on nonetheless. So, a few things. Firstly about the BRGM. The BRGM... is fluctuat nec mergitur, which means that it survives in all circumstances, whatever evolution brings. There are several examples to prove this. First of all, it's kept its name throughout that period, whereas with other organisations, most have given themselves additional letters or new... roles that mean they have changed. But we don't change, we're the BRGM. Its mission has evolved, but it's still the BRGM, and people like it that way. People know the BRGM, after all. So... To achieve that you need a supple spine, which is to say being able to adapt to demands. Because the BRGM is useful only if it provides something to the community. On the one hand, cartography and all the technical facilities that are indispensable for work, but also to satisfy a number of considerations, some of them political, let's have no illusions. So, according to the political circumstances, the BRGM has been obliged to take on new specialities or get rid of others, gently. And that is what I want to talk about. Because the BRGM functions in a world that is on a 1,000-year basis, more than 1,000 years, etc., but the world of politics changes quite rapidly. When you look at the number of presidents the BRGM had during a certain period, you might imagine it's pretty quick. So it's quite a delicate mix, and I think on the whole we're coping well, because we continue to work over the long term despite the changes all around. So the BRGM has survived well. It has done this by obeying a number of rules that are essential. That is to have a large number of different techniques, and be able to bring together people from various origins and knowledge backgrounds to find solutions. Secondly, the specialities that you touch on are ones that are relatively focused and should not be mixed with politics in general, or a whole load of other things. So it's very good to have a specialism and to stick to it. On that subject, I would say that sticking to it isn't always easy because there are places where you can be financed and have development capabilities, and there are others where if there is no client, there is no client, which has been the case in recent years, when mining activity has been unpopular, and so that area of endeavour has not provided opportunities for research. That brings me to a point which, personally, I find hard to understand: how can we continue to do mining research when no mining is taking place? It's a uniquely French thing and it astonishes me. Because... carrying out mining research above ground would be difficult. That said, the things that have been said are extremely important. I won't repeat them, but there are several things I'd like to say. Firstly, we have to watch out for all new technologies in case the tools used by others and those in development could be used by us, as it's easier to use another's work than to do it oneself. Secondly, we have to experiment with those new products and hold on to all the knowledge. That is yet another... I'm mixing things up a bit as I didn't prepare my speech. Holding on to knowledge means holding on to people, even when, for one, two or three years, or more, they may not have... objectively a specific role. It means they can put their pencils away, but also that they can think and do other things and, in particular, so far as mining research is concerned, enables them to retain their skills. Because mining research involves as much field work as it does... What did they call it? One of my BRGM colleagues said there were field geologists and console geologists. I'll go no further on that subject. And in fact, I had the idea that you are doing well, you are at once supple, active and you evolve quickly, so everything's fine. So now, I have one small thing to add, and it's a pet subject of mine, which is rare earths. Rare earths are an especially difficult subject, and we've lost, clumsily, I may say, our knowledge of them. And that bothers me enormously, because today 30% of rare earths or thereabouts are made in China. It's very polluting. It's very polluting. Obviously, it's very difficult because as we're in favour of dealing with pollution, we're on both sides of the fence. We're promoting polluting activities and then saying: "We have to de-pollute." So we give the impression of not being objective. We must remain technical and not question ourselves. But I am very sad that France has not held on to the know-how that was Rhône-Poulenc in the old days. It was all sold. That said, I'm not here to play politics, so I'll say... I'd like there to be an anniversary every year, at least, and not every 10 years. But I thank you on behalf of everyone here for organising this symposium which is very interesting. I'd like to add that our friends from overseas or rather our neighbours, are vital for a body such as ours, because international exchange opens one's eyes to other approaches and that's essential. For example, the business of town and country planning is something I agree with. I think that in your country, it's essential. Here in France, there are still many trees, meadows, etc., so we're less restricted in the use of land. But we'll get there too, and there's no alternative. You quoted a thing, hold on... Yes, town and country planning. I worked in that area in the past. I know that those subjects are not discussed because they are interdisciplinary and so complex that no-one can concentrate and deal with them logically. Right. I've finished. Thank you. Thank you.

Thank you. Thank you, Bernard Cabaret. I invite you all to take a well-earned break before we embark on the next round table to which Bernard Cabaret's introduction was, to say the least, well-informed and wise. We thank him for that. A short 20-minute break and we'll start again. Thank you.

Securing the supply of strategic mineral resources

"Subsurface challenges in the 21st century" conference – Closure

Transcription

You're all wondering: "Is it nearly over?" No. We still have the conclusions that review the key information and ideas which came out of the two round tables. You're going to have to wait before we end this symposium. We'll start with François Robida, who is going to summarise what was said during the first round table. François Robida is the director of the programme that deals with this subject: Geoscience and Environmental Data-Cycle Management. So François... We'll let him have a drink, because before talking it's always a good idea. So here is a short but productive summary of the ideas expressed during the first round table.