In response to river floods, coastal flooding, drought and the shrinkage and swelling of clay soils, cyclones and storms, hail and agricultural losses related to climate hazards, the French insurance system has been faced, for the past two decades, with increasingly costly claims related to the development of climate risks. By 2050, climate change will make this situation even worse.

This raises the question of the sustainability of the natural-disaster compensation system. There is also a temptation for insurers to withdraw from the highest-risk areas.

11 major objectives and 37 recommendations

![Submission of the report "Adapter le système assurantiel français face à l'évolution des risques climatiques” [Adapting the French insurance system to changing climate risks] on 2 April 2024.© Ministry of the Economy, Finance and Industrial and Digital Sovereignty Submission of the report "Adapter le système assurantiel français face à l'évolution des risques climatiques” [Adapting the French insurance system to changing climate risks] on 2 April 2024.](https://www.brgm.fr/sites/default/files/styles/background_centered_full_width_desktop/public/images/2024-04/actualite-rapport-assurance-climat-001.jpg?h=3aec2b2d)

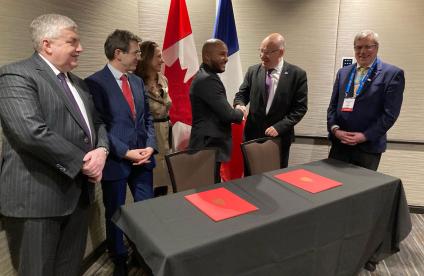

Submission of the report "Adapter le système assurantiel français face à l'évolution des risques climatiques” [Adapting the French insurance system to changing climate risks] on 2 April 2024.

© Ministry of the Economy, Finance and Industrial and Digital Sovereignty

It is against this backdrop that three experts, Thierry Langreney from the association Les Ateliers du Futur, Myriam Mérad from the CNRS and Gonéri Le Cozannet, a BRGM engineer specialising in coastal risks and climate change, and one of the authors of the 6th IPCC report, were appointed by the Government to investigate the insurability of climate risks.

On 2 April 2024, the 3 experts submitted their report to Bruno Le Maire, Minister for the Economy, Finance and Industrial and Digital Sovereignty, and Christophe Béchu, Minister for Ecological Transition and Territorial Cohesion.

Based on contributions from 150 people representing some sixty organisations, some professional and others from civil society, the insurance sector, research and the climate sciences, the report sets out 11 major objectives and 37 recommendations.

Key figure

-

The Caisse Centrale de Réassurance estimates that the average amount of claims due to climate change alone will increase by between27.00and 62%by 2050

Preventing insurers from withdrawing from the highest-risk areas

The recommendations set out in the report aim to:

- put the natural disaster compensation scheme back on a balanced financial footing,

- strengthen individual and collective prevention in the face of climate hazards,

- maintain a protective insurance system that is accessible and shared by all policyholders,

- promote actions to reduce greenhouse gas emissions.

In particular, the report proposes a tax bonus-malus system for insurance companies, based on the level of exposure of insured areas to climate hazards, to prevent certain areas from being abandoned by the insurers.

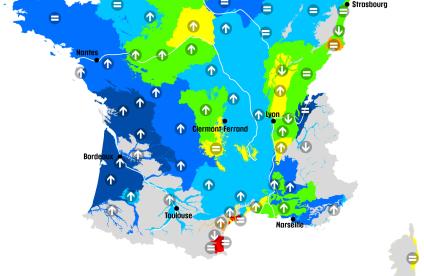

Strengthening preventive measures and improving risk mapping

The experts also recommend stepping up prevention efforts to limit the rise in claims costs. This means supporting investment in the resilience of buildings, but also improving our knowledge of risks, in particular by consolidating the mapping of areas exposed to the main major natural hazards throughout France. BRGM will be contributing to this mapping exercise.