In what ways do you interact with minerals in your daily life?

Transcription

Ever asked yourself how you interact with mineral resources in daily life? They are everywhere. As soon as you wake up. At breakfast. On the way to school. In the classroom. On your lunch break. In the computer room. In the street. When you're having fun. At dinner time. In the bathroom. And when you go to bed. Mineral resources are precious and essential to daily life. Mineral resources are used in all sectors of activity, valuable for their incredibly diverse physical and chemical properties, such as, for example, solidity, conductivity, colour. This is why the objects we use daily are packed with a range of different mineral resources. Do you know, for example, how many different minerals are contained in an alarm clock, a bicycle or a digital tablet? A can, a car, a tube of toothpaste? Mineral resources are necessary to create objects we use every day. Among the main mineral resources used we can mention minerals containing copper, as this metal has excellent conductive properties, minerals containing cobalt as this improves power storage in electric vehicle batteries, minerals containing tungsten, as it is highly resistant, rare earth elements, as they contribute to energy transition, and sand, which is the third most consumed substance by mankind. Now let's turn to the questions and answers!

Where do mineral resources come from?

Mineral resources come from underground, extracted from mines and quarries by humans. The geologist is specialized in the study of underground matter. Mineral resources are extracted from quarries, particularly for sand, gravel, rocks, or from mines to extract gold, copper or iron, for example. The two types of mining operations are open-pit surface mining, carving out exposed large-scale pits, and underground mining, by drilling tunnels to access deposits. Both open-pit and underground mining can reach, on average, a few hundred metres below ground, while quarries, on average, only reach tens of metres in depth. The location of mines and quarries is not random as it is by studying the nature of the underground and its deposits that we determine the best approach. In other words, geology!

How are mineral resources created?

Mountains, basins and oceans are created by the movement of tectonic plates. For example, when two tectonic plates collide, this can form a mountain range. And when certain specific conditions are met in terms of pressure and temperature, this can form mineral deposits. The dynamic nature of Earth's geological movements creates deposits.

And what are mineral resources used for?

Mineral resources are in just about everything, even where you least expect them. For example, they can be found in medication, constructions, particularly in walls, glassware, tiles, garden furniture, vehicles, pastel crayons, even paper.

But are mineral resources really indispensable?

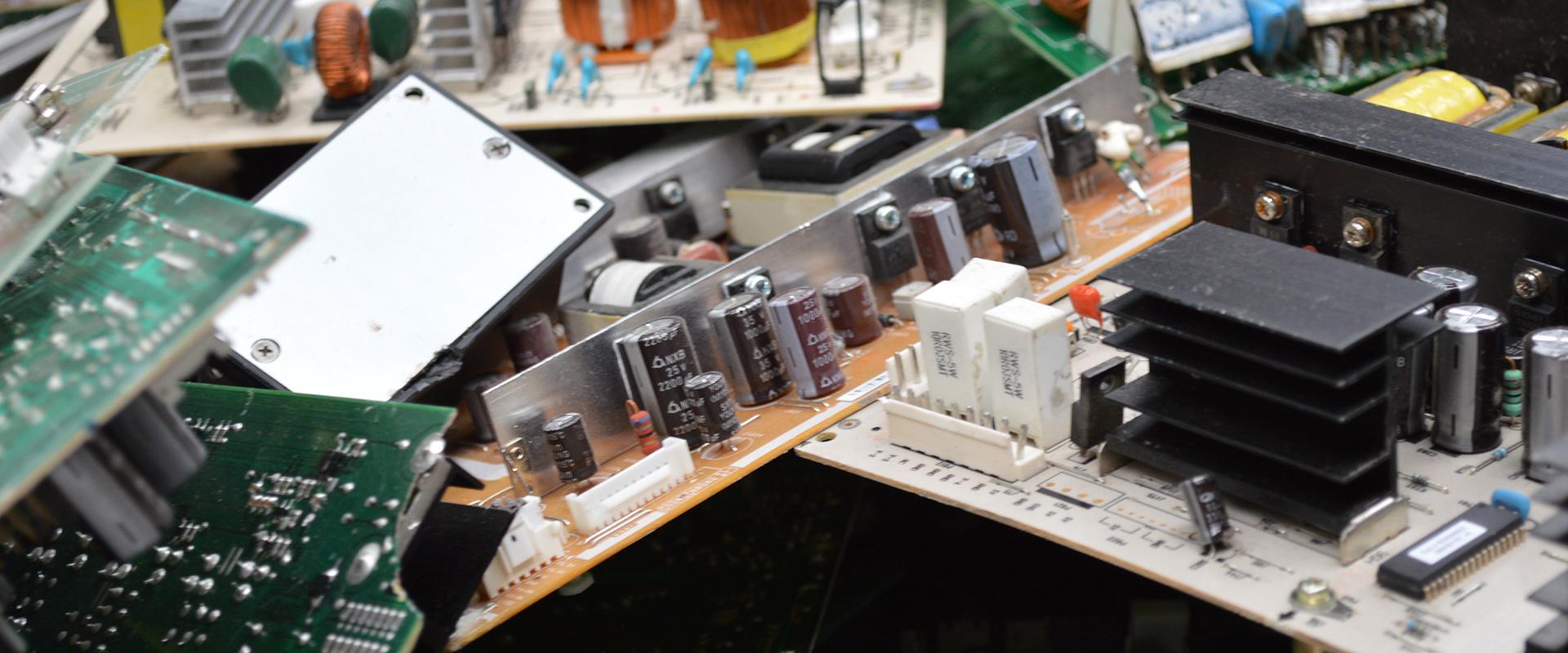

Yes. These are indispensable at the moment. We have not yet found any alternatives to these resources as they provide a diversity of functions that is hard to match. For this reason, they must be used responsibly and within reason. Mineral resources available today took tens to hundreds of millions of years to form. To put things in perspective, consider that the quantity of minerals extracted by man in the past century is equivalent to the quantity extracted since man first appeared on Earth a few tens of thousands of years ago. A staggering amount! The central issue, beside that of available resources, is access to deposits in the future, which are increasingly deep underground and complicated to extract, always requiring more advanced and expensive technology. We need to design our products to be more sustainable and recycle already extracted materials to preserve our mineral resources.

Strategic metals for the energy transition

Transcription

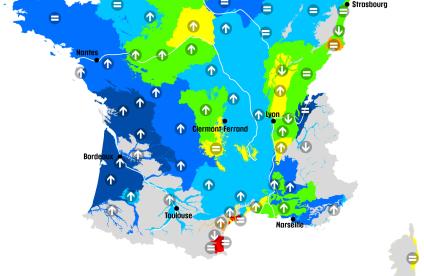

Thank you for your invitation and your request to work with you. This topic has been back in the news for a few months. I will present you a broad outline and by no means an exhaustive overview as this would be too fastidious and would require much more time. Before we begin this conference, I would like to say a few brief words, about who we are at BRGM. We are an EPIC, a public institution of a commercial nature, like CEA, under the supervision of the Ministry of Research, with around 1,000 employees, and which is today France's leading authority in the field of soil and subsoil and geoscience applications in a variety of sectors, and which acts as the national geological service. As such, we are involved in both research and public policy support activities. Together they represent about 35% of our operations. And two more specific activities: the management of former mining sites in France and a number of contracts with corporations, including abroad. We are mainly located in Orleans with regional offices in every region. Isabelle, who is here, represents BRGM in the region and will gladly discuss BRGM's expertise with you. We have six main areas of activity, as shown in the upper right-hand corner: water, contingencies, subsoil science, subsoil uses for energy transition and mineral resources. This is the topic of my presentation, as it is a key aspect of our work. This presentation will be organized into four main sections. First, I will demonstrate how the energy transition being undertaken will shift us from the dependence on fossil fuels with which we are familiar, to an extremely heavy dependence on metals. Sourcing these metals is not a simple matter. Supply chains are complex and hard to master. Bearing in mind that we are essentially dependent on imports, we must ask how we can build our resilience by reclaiming these value chains. So, item number one... How will the energy transition impact our mineral resource needs in the broadest sense? Energy transition, I think everyone here is familiar with this issue. This figure illustrates the key challenge, greenhouse gas emissions since the 1980s, and the surge until today. The dotted line is the current trend. It shows us that our economic model, our current societal model, is not sustainable: it results in extremely high GHG emissions and if we do nothing it will disrupt the climate in a lasting and significant way. To limit this impact, as you all know, we must considerably reduce our GHG emissions and part of these emissions are related to the energy sector. When we look at our global energy mix, our different sources of energy consumption, the figure on the top right, bubble size represents each source's contribution. Coal is the black circle, at 29%, oil is at 31%, gas at 21%... They are arranged according to 2 important factors: how much CO2 they emit on the vertical axis, the higher they are, the more they emit, and the capacity factor, the ability to produce energy when it is needed. The further right it is, the more capable it is of meeting demand, and on the left is intermittent energy. Of course, if we want to reduce GHG emissions, we have to reduce those at the top, which emit the most, i.e. carbon-based energies, which today represent about 80% of global consumption. And low-carbon energies will have to be considerably expanded, and this is the path we have begun to take. These energies come in two forms: nuclear, with which most of you are already quite familiar, and renewable energies, which are distinct on this chart: they diverge significantly to the left. So their production capacity is intermittent which will obviously make the energy transition considerably more complex. This energy transition, and we will see what it entails in terms of materials, aims mainly to improve our energy efficiency and thus better use of available energy, develop low-carbon energies, nuclear and renewable, and since this new energy mix includes intermittent energies, these will require a sufficiently advanced and intelligent network, so to speak, to cope with spikes in production, in demand, etc., and storage capacity to deal with the intermittence. And all this has a substantial material cost. If we now zoom in a little on these energies of tomorrow, as part of the energy transition, nuclear and renewable, here is a chart presenting how we project their growth by 2040. This chart, like many of those I will show today, comes from a report by the IEA published last year forecasting the evolution of global energy mixes and mineral resource requirements: in green, photovoltaic, in blue, wind, and dark blue, the power grid, which must evolve in order to accommodate these new energy sources. Then this energy has to be used. We will see this with electric vehicles, here in red. The first data point, the first bar, is for 2019. The second is a model that corresponds to policies that have been adopted in different countries. And the third bar is a sustainable development model that meets the target set by the Paris Agreement of a maximum temperature increase of 1.5 degrees. The chart speaks for itself. The means of production, whether photovoltaic or wind power, will have to expand considerably. Annual growth rates will multiply at least by a factor of 3. The electrical grid will also have to adapt and all this depends on material resources. And it's even worse with energy use, for transportation, there could be a 25-fold increase in electric vehicles. All this of course leads to significant materials requirements. Here is an example. A wind turbine diagram. You can see that a 3 GW wind turbine today will require substantial quantities of concrete and steel, when it comes to conventional materials, but also less conventional materials, such as rare earth metals, potentially several tons, or copper. Certain metals that didn't use to have much use, like rare earths, are somewhat new to the market and may not be readily available and accessible. It's important to understand that each energy source has quite different material needs. For simple things like steel, with the different energy production technologies from hydro on the left to solar on the right, the amount of steel required to reach a given installed power capacity is radically different and the lower the energy density, so wind or solar, renewable energy, the more materials, steel, concrete, and a number of other exotic materials will be needed to build the infrastructure. And this doesn't even cover power generation, since intermittency has to be factored in as well. What does this mean in practice, if we do a quick overview? Here, for example, the lower chart presents methods of power generation, wind, solar, nuclear, coal, gas, and the quantity in kilos of materials required for 1 megawatt of installed capacity. You can see that between a coal-fired plant and the same installed capacity for offshore wind, the most efficient will require six times more material for the same installed power, keeping in mind that intermittency means power generation will vary. And the colors are different because different metals are required. There are similarities, steel is everywhere, but you can see rare earths appearing, as well as zinc, etc. Elements that were not as important before. That's power generation. The chart above compares a conventional vehicle, on the bottom, and an electric vehicle on the top. It multiplies by 6. This means that an electric car does indeed emit less CO2, but with the battery and everything else, you need 6 times more mineral resources in order to build the vehicle and therefore to be able to actually use it. All of this put together adds up to quite a lot. The figure on the left here shows the overall increase, everything combined, in mineral resource requirements for the two models I showed for 2040: the model with existing policies and the ambitious 1.5 degrees model. It will take 4 to 6 times more mineral resources than we use today. And if we zoom in a little more, element by element, on the right, certain elements get a little scary. We will need 42 times more lithium! The growth rates are extremely high and beg the question: are these materials actually present underground and will we be able to access them? You can see that rare earths have a factor of 7 and more conventional elements like nickel or graphite, which we already use, have factors of around 20, so very high. There are the main metals, the historical, traditional ones, and newcomers which will obviously have a major part to play. That's it for the global data and figures. Now the question is: what about France? Our energy is already less carbon-intensive, so do we also face this challenge? Looking at our GHG emissions, here on the left, you can see that they are already decreasing. This doesn't include any comparisons but they are low compared to many countries, keep that in mind, in particular thanks to our nuclear power. Secondly, you can see that the major contributors are transportation, residential and agriculture. Taken together, they account for nearly 2/3 of our CO2 emissions. So our power generation, our energy industry, emits very little CO2, which sets us apart from the rest of the world. It accounts for barely 10% of our emissions. But the government has now adopted a national low-carbon strategy, which aims to be carbon neutral by 2050: we will emit as much CO2 as we remove by then. Looking more closely at this strategy, in this chart, certain colors will completely disappear. Those will have their CO2 emissions eliminated. I'll return to this. Others we will try to reduce, but cannot eliminate altogether. Among those that will disappear, in order of appearance, at the top, in blue, you have transportation. By the end, there is almost none left. Indeed, in France, we have the ambition, this is the current policy, to completely cut GHG emissions from transportation. Hence the issue of electric vehicles, batteries, etc. We will spend a lot of time on this because it will shape the future of our industry. You also see, in green, the residential sector, where we also hope to eliminate our emissions. And the third, which is... The energy industry, in dark blue at the bottom. I don't have a pointer, but it's above the black. It was already low but we want to take it to 0. What remains are residual emissions from industry and agriculture, offset by carbon sinks, including CO2 capture. This raises the question of material needs, not only for power generation, electricity, but also the use of this electricity, and in particular the key issue of transportation, which is the main source of GHG emissions today. When you put it all together, this is what you get. In case chemistry class was a little too long ago, this is Mendeleev's periodic table of the elements. The colored ones are elements we will need for the energy transition. If I had done this talk a century ago, I might have colored in 4 boxes. 5 or 6, tops. Today, we need more like 30 or 40. So you can see that we will need many different minerals and materials, this is very new. The different colors you see correspond to the different sectors. Blue, for example, is energy storage, dark yellow is nuclear, you can see boron, zirconium, hafnium, etc. I won't go into detail. You will get to see the slide for more details, but you can see that we need a wide range of mineral resources. And we need a lot more of it, as I said. Essentially, we will need to extract and use more mineral resources between now and 2050, so the next 30 years, than mankind has extracted and used since it started doing this 2,500 years ago. This is an extremely abrupt shift which could generate disputes over resources, since, of course, these are limited. In terms of disputes over resources, the energy transition is not the only area in need of minerals. There is another important driver that simultaneously requires a lot of mineral elements: the digital revolution, which moves extremely quickly. Here is a map of Internet usage rates. You might think we've reached the end of its growth but there remains one continent, Africa. The Internet is still growing. This chart shows the amount of data transferred each month. This also speaks for itself. The trends are pretty much exponential. We live in a world where technology is everywhere and we need technology for the energy transition. And technology consumes power too, as the figure on the right shows. This is the energy consumption of digital technologies alone. Today, that is about 4 to 5% of global energy. Current models say, again, these are just models, that within the next ten years, it could account for up to 20% of the world's energy. Energy means infrastructure, material needs, etc., which compound on top of prior needs. These compounding effects move in the same direction and drive this acceleration in mineral resource needs. As for technology, we always think of our digital devices that live in our pockets and that we can't do without, but they require a lot of material and infrastructure. We tend to forget that. First, there is the web's network infrastructure. Here is a map of the major submarine cable networks which form the backbone of the internet. Today, this amounts to more than 1.3 million km. That's in 2021. They are fiber optic cables made with conventional resources, like steel, copper, etc., but also more exotic materials like germanium. The quantities of material are not insignificant. And we also have more and more data. The graph on the right shows the data explosion that we are accumulating from all over: our photos, documents, etc. You need data centers to handle all this which also rely on microelectronics, and this requires large amounts of energy and materials. All this adds up... Here, for example, is an object that we use every single day. Here you have a smartphone. You can see that each color around the device corresponds to a different chemical element. There are rare earths, tungsten, gallium, etc. A whole range of elements that need to be sourced and are present in significant quantities. If we look at the amounts contained in each one of these objects, some of them exceed what you would find in ore underground. The amount of gold in this object, for example, is about, on average... several hundred times more concentrated than in gold ore extracted from the ground. Together, these quantities of materials are substantial. And we need these same elements for the energy transition. So when we look at the chemical elements needed for IT on the periodic table, we can see that a number of elements overlap with the previous table on energy. To simplify things, I crossed the two tables. All those in blue are only used for energy, those in green are only for digital and the two-tone boxes are for both. All this to show that we can't think about the energy transition without addressing the digital transition, or consider IT without the energy transition, they depend on one another and require the same material resources. The most important thing to remember about this first part is this chart on the right. We have gone from a relatively simple world where we sought out a few chemical elements in the subsoil that were relatively concentrated and easily accessed, to an extremely varied array of elements today. And I have no doubt that in 10 or 20 years we will be using the entire periodic table. And in far greater quantities. Now that we have presented this challenge, since it is indeed a challenge that we are facing, this global context... The second point I wanted to address and try to shed some light on, is making it clear how difficult it will be to meet all of these needs and how complex the supply chains are. I won't go into what happens specifically for copper, lithium, cobalt or nickel. I will highlight certain aspects that I think are fundamental and apply to many different chemical elements. We've already mentioned the first point: elements rarely only have one application. There could be competing demands. We will have to decide whether it is better to boost the energy transition or the digital transition. Should we prioritize aeronautics? In a world under tension, in a finite world, which we will be facing, we will likely not be able to meet all demands at affordable rates. Copper is a very good example of this. You can see that copper is used in about 40% of everything related to power transmission and generation but that isn't its only use and it can of course also be used in construction, transportation, and many other industries. If we were to significantly ramp up our copper requirements for the energy transition, that would represent an additional 9 million tons per year by 2040. Will we be able to meet our other needs, or will they run out? This is an important question. Will we even be able to meet this demand? That is what you see here. First of all, what you have here is the evolution of copper production in the chart on the left, - the lower part of the chart, in dark gray - from currently operating mines and facilities. We can see that it will go down in the next few years as new operations are needed to compensate for the depletion of a number of older mines. Activities being developed are in light blue. This extends the supply a bit, but there's still a gap at the end. So our current mines won't be enough. We need to explore and open new mines, or we will never be able to meet demand. For demand, I put the 2 models we mentioned: STEPS, that is, current policies, and SDS, the ambitious model for a 1.5 degree rise in temperature. But could we open these mines? Moving to the chart on the right. You can see the annual production for the last ten years compared to reserves, reserves are read on the left axis and production on the right axis. There is a factor of 10 between the two, a significant gap between production and reserves. So reserves are there, or at least for copper. There is still plenty in the ground. But how will we access it? Because resources are less and less concentrated and take more and more energy to reach. Societal acceptance of this type of industrial activity isn't always easy and the environmental impact may be significant. There are a lot of things to consider. And that means that the price of copper goes up, as you can see here. Here are the changes in the price of copper over the last twenty years and of course there are ups and downs, cycles, economists describe this very well, but beyond these cycles, there is an upward trend and those taking this subject seriously say that it won't go down. So we have to realize that we will be in a world where the price of copper will rise, even if it continues to yo-yo at times. That's the first point. We have significant reserves, not for every need, but for copper we do. But it will be extremely complicated, expensive and slow to access. Secondly, still on the subject of mines. We often only see the mine and then the finished product. But between the mine and the finished product... For example, the power line that runs near your home. There are many industries and processes, all potential bottlenecks or hurdles, necessary to ultimately build your electric vehicle or power line. So here is one example. I switched elements to present a few other minerals. So here we have lithium, which is a key element for batteries. Lithium can come from two types of resources: either it comes from what we call brine, salt water that is concentrated and contains lithium among other salts. This is what is done in the lithium triangle: Chile, Argentina and Bolivia. Or it can come from solid rock as is done in Australia and maybe one day in France. And you see on the diagram on the left with the different processing steps that between the column on the left for brine and solid rock on the right, it isn't the same. The steps are not exactly the same. And this is very simplified. And what isn't fully apparent is that each step isn't necessarily in the same country. In the case of solid rocks on the right, for example in Australia, rock is extracted from the ground and processed, crushed, dissolved, etc., locally, of course. But step to separate out the lithium is mainly done in China. And the resulting product, lithium carbonate for example, isn't useful for batteries. It will need to be transformed again to make batteries. So there are many steps in the process, and managing supplies means being in control of these steps. If you overlook any part of the diagram, of this value chain, you can be completely off the mark. This can lead to some pretty complex situations. Staying with lithium the complicated diagram on the top left shows the processing steps. I start on the left by extracting lithium from the ground or from brine. This is the green section. Then there are processing plants in different countries, in orange. Some material goes away because there are losses, the extraction isn't perfect, and it has other uses besides batteries. But as a result, the volume, represented by the arrow size, gets smaller and smaller. And volume of batteries, the last arrow on the top right, is small compared to what I extracted. There were lots of losses along the way and a lot of different potential uses, and each of these nodes, these forks in the road, is a step in the material processing chain that needs to be mastered in order to have lithium to make batteries. This brings me to an important point about the environmental footprint... This isn't true for 100% of batteries, but for some today in France, the lithium in some electric vehicle batteries was extracted from mines in Chile, turned into hydroxide in the USA, electrode components are made in Japan, battery cells in South Korea, the battery is manufactured in the USA, and finally the vehicle arrives in France. The lithium in your battery has been around the world 3 times over 50,000 km already. When we talk about CO2 footprint and supply chain management when an epidemic disrupts this supply chain, the resilience and the long-term success of our industries becomes difficult to ensure. The third important point... some of these metals are not extracted alone. They do not occur on their own underground, but are extracted as a by-product of another metal we were after. That's what this image shows, the redder the color, the more that metal is obtained as a by-product of a processing activity, and the bluer it is, the more it was mined on its own. For example, iron is in blue in the middle, we have iron mines where it is extracted. But we have no cobalt mines. We extract it from iron or copper ore or from other resources. This is important, because it means it is actually even more complex than I explained. We can identify iron mines and its processing industries, etc. But if an element has no mines, it will depend on other elements and those elements' logistics. Geologists and mineralogists know this all too well. There are carrier elements, which you can see in the center of the circle in blue, which produce their own minerals in rock, so they can be identified and found directly. And all the others are accompanying elements, either as secondary minerals or as impurities, or substitutional within the primary mineral. So all those which don't appear in the first circle need to be extracted as by-products of the processing of a more important metal. So dealing with a market for a product that isn't extracted from the ground for its own sake isn't easy. The market's logic isn't tied to the element you want but to the primary element. You can have production fluctuation effects and the alignment between supply and demand is extremely complex. But a picture is worth a thousand words... And this is also a situation where France plays an important role. This is hafnium. It's used a lot in electronics, nuclear power, and other areas. I won't go into detail, but there are no hafnium mines so that's not how you get it. It is often found mixed in zirconium ore, which provides the zircon for nuclear fuel cladding. There is only one way to produce hafnium: when zirconium is purified to make fuel cladding, the hafnium is removed, which is advisable, as reactors don't much like it. So it has to be done, and we get hafnium as a result. Hafnium, an element we need for a number of modern life devices and power generation, actually ties back to nuclear power. If we stop producing nuclear fuel, we won't have any more hafnium. But we need it in our iPhones and many other things outside of nuclear power. These supply issues are extremely complex because they are so closely intertwined. I can't discuss all of this without mentioning electric batteries. We saw that batteries create a 25-fold increase in material needs. So it's one of the main challenges, because transportation is the biggest GHG emission source, so it must be dealt with, and secondly, it is the greatest source of increased material needs. That's what you can see here once more, you can see the considerable increase that is expected by 2040. So... These batteries in electric vehicles, what are they made of? Without going into too much detail, on one side we have a cathode, which is essentially made of nickel, manganese, cobalt and sometimes lithium. Many trace elements can be added to improve material properties, but we'll stick to the main ones. There is an anode, the negative pole, which is mainly graphite which is functionalized by adding trace elements and lithium between the two, the electrolyte, which carries charge exchanges. And... It's quite simple in principle, except that when you look at its components, a certain number of elements, in red here, are "critical", because their supply is not secure. I'm thinking in particular of copper, lithium, nickel, cobalt, graphite... Now you're thinking, "But you just listed them all!" Yes, we're nearly at the point where all of the materials we need to make batteries come from outside Europe, and there is a real challenge in securing our supplies. I'll skip this chart. However, Europe is strongly engaged on this issue. You've all heard about the battery plan and the Gigafactories being built all over Europe. We are privileged to host 3 large projects in France. There are currently 22 in Europe. These are multi-billion dollar factories that will produce batteries for our future electric vehicles to shift towards electric transportation in Europe. Except that when you look... The chart here on the right shows the three stages of battery manufacturing. I collect materials, I process them, I build components and I make my battery. And what you have... It's not very clear, you can't see it very well... How does each stage supply itself? So first of all, where is Europe? If you can't see it, that's normal, it's the first line. So for the first stage, we have 1% autonomy for raw materials. We have 9% or 8% autonomy for processing, 9% on the manufacture of electrode components so you can see that we are over 90% dependent on imports when it comes to carrying out this transformation. Here is the list of countries. The very visible one, the big red bar, it won't come as a surprise, it's China. We are very dependent on China to supply to supply the entire industry, which is the key to Europe's energy transition. So... That was batteries. I could tell the same story about other subjects. Another is permanent magnets. We need them to produce electricity with wind turbines and in engines to convert electricity into horsepower. And today, we do this with rare earths. This creates extremely high demand for rare earths. And when you look at the rare earth supply chain, the bottom section, it is, again, completely dominated by China. 70% of rare earth mining activities are in China. For processing, i.e. producing separate metals, it is 90% in China and 100% for heavy rare earths. Alloy manufacturing is at 90%. Permanent magnet manufacturing is at 90%. There are no offshore wind turbines without permanent magnets or electric cars without permanent magnets. So 90% of wind turbines, 90% of electric cars, have a significant part of their added value, of what makes them tick, coming from China and over which we have little control today. So this story is worth taking a closer look at, because 30 years ago, 60% of the world's rare earth processing was done in La Rochelle. Unfortunately, we let this industry go for a lot of good reasons, all of which relate to this country's de-industrialization and the fact that environmental regulations in China are much more permissive in this area. China repatriated all this expertise with our help because we were happy to see it go to China. Then they went up the value chain, starting with mining, then processing, then rare earth separation, and today they are the only ones who know how, then magnet manufacturing. They integrated the entire value chain and 90% of the world's magnets come from China. This strategy was planned for the long term and is not at all accidental. So what about nuclear power in all of this? And I'll end this second part with this. I am using a chart from earlier, but I changed it from installed capacity to power generated. How much metal does a nuclear reactor need to generate a given amount of power compared to other technologies? The figure speaks for itself. Nuclear power is an extremely efficient power source which uses few resources compared to the amount of power generated. There is 16 times less mineral resources in one terawatt-hour of nuclear power than in one TWh generated by offshore wind turbines. So the mineral resource requirements for nuclear power such as it is projected... We could discuss the IEA's models, but it wouldn't change much. It's less than 0.2% of our total needs for the energy transition. So nuclear power has the advantage of having low mineral resource requirements. It has other drawbacks, but this is a strength that deserves to be studied and perhaps promoted more. So, lastly... All this brings me to our position in Europe and how we can try to rectify this. We are highly dependent on foreign sources for a large part of our mineral supplies. This chart shows a number of chemical elements. I won't go into detail, but 100% at the very top means that we are 100% dependent on imports. We have no production within Europe. I'm not even talking about France. Then on the right, we have more varied positions with a certain level of autonomy. But for many materials, we are totally dependent on other countries. Red being, once more, the position of our Chinese partners. And this dependency extends to many countries. This map shows European supplies for a number of mineral resources. We can see the major mining countries, like the USSR, the Democratic Republic of Congo and Latin American countries, the United States, Canada, Australia... and so on. South Africa for platinoids. And dependency can reach almost 100% for some resources. And for some of these countries, it accounts for most of their activity. So they themselves are extremely dependent on us here. One particularly prominent player is China. Here is China's global position for a number of metals. The red line at 20% is the Chinese population's percentage of global population. If things were equally distributed, they should be around 20%, but many elements are higher than that. And if we look at how mineral production is growing today on a global scale, on this figure on the right, Europe is the constant blue line that doesn't move much, while other countries are growing rapidly, especially Asia in yellow, which is driven by China, which invests heavily in its mineral resources. Is this dependency something we are condemned to or is there a way to reclaim these value chains and rectify the situation? This is my last point before I turn the floor over to you. The first point is recycling. This needs to be developed, because the resources are here. It is an opportunity for value creation and industrialization. The chart at the bottom shows that our waste volumes are increasing. Today in Europe, we produce around 7 kilos of electronic waste per inhabitant, which isn't insignificant, full of copper and other metals. So expanding recycling is an interesting possibility. We are far from being advanced in this field. Here are the recycling rates, on a periodic table, of the different elements. When they are in red... I can't see it well... ...the recycling rates are very low, nearly zero. And in the green spectrum, they are between 25% and 50%. The blue spectrum is above 50%. There are only 3 chemical elements that are recycled at over 50% and the rest are below 50%, so there is work to do. Will this solve our problems? This is an important point. Here's the answer: no. Why? This is a theoretical model, but it is interesting. Imagine we have produced a certain amount of material, objects containing a valuable resource, in blue. When we recycle them, we will recover objects, in light blue, but we will lose some, because we can never recover 100%, in yellow. An arrow is lost. Then the physical and chemical treatment stages, etc., there too, we can never recover 100%, it's contrary to thermodynamics. The green arrow is recovered but the purple one is permanently lost. We will never reach 100%. There is always loss. This is an important point: we could only subsist on recycling if our needs decreased, and that reduction would have to match the losses at each stage of recycling. Except that our needs are growing. Our needs, as we saw earlier, for example, the red line shows our copper needs, are dramatically increasing. If I set myself in 2100 for example, to simplify, point 9 on the top right, at that date, my needs correspond to point 9, but the amount of material contained in end-of-life objects is at point 8. Objects have a limited life span, and I don't recycle them right away. This delay results in a gap in available quantities of which I recover only a fraction. So recycling will not solve these problems. And experts say that recycling, at best, could account for half of some resources, no more. So no matter what, new mining activities and quite substantial ones at that, are clearly a necessity in order to develop and implement the energy and digital transition. Are there still resources in the ground? We said there are. The subject seems somewhat novel in France, because we've forgotten it, but this is not the case in other countries. Looking at the map on the right, each dot is a mining project. This map is from 2020 or 2021. You can see how many there are. Colossal sums of money are spent. For China, more than 200 billion. The United States, over 200 billion, almost 300. For all of Europe, it's around 70 billion. It's not much. And if I zoom in on France, there are no red dots. This is of course a coincidence, but it raises a real question. To develop all this, we need mineral resources. We can't always rely on foreign resources. How easy is it to access these resources? From the moment we need lithium or copper to the moment we open a mine, if everything is done as quickly as possible, it will take on average at least 15 or 16 years. This is what this chart shows. And that's for countries without particularly cumbersome regulations, etc., which leads to longer timeframes. So there is a certain inertia, but the nuclear industry is used to this. There is a lot of inertia in the system. Between the time you need copper and the time you get it, 10 or 15 years will pass, at least. Earlier I said that we will have a copper deficit between 2020 and 2030 so that's a good question. Secondly... we will have to integrate, this is important in the French strategy, the environmental impact. We can't develop mines in the way some countries have in the past. Today, mines must be environmentally responsible in terms of CO2, water consumption, pollution, land use, etc. And it's complicated, because the impact varies from one element to another, one process to another, one country to another... We want to control our value chains and our supplies and we want to source low-carbon resources, which are respectful of populations, etc. It's very difficult to track, because it will be site-dependent. It will depend on the location, systematically. And the concerns of local populations must be taken into account. This is a fundamental aspect of sustainable development which France is fully committed to. We imagine that France has none of these resources left, that we have depleted our reserves. This is absolutely false. The existing French mining inventory, which lists resources of global importance, was established with data collected in the 1970's. We haven't done anything since, we have no data beyond a depth of 200 or 300 m. Today, when we consult our experts on the matter, and BRGM obviously has a few, we are able to produce predictive maps. Even if there is no guarantee, there is a high likelihood of finding valuable resources. I only used one, but there are dozens I could list. Here is our predictive map for lithium on the European continent. France certainly isn't short-changed. We have potentially valuable lithium resources, some of which would be quite easy to extract, whether as solid rock, underground mines, etc., or in deep brines which can be pumped and from which lithium can be collected. A demonstration project was recently launched. Eramet communicated extensively about it. So it isn't true that we have no resources. We ignored the issue. We would rather have it done far from home. But it's a real issue and our Minister of Ecological Transition has spoken clearly on the matter. We must take responsibility for our policy decisions, in particular the energy transition, and the mineral resource requirements that it entails. I'll skip this slide. And then of course, we won't find all the resources we need in France, so we must also secure resources abroad with long-term contracts and only from environmentally sound sources. This is the issue of mineral resources diplomacy. We are lucky to still have some mining companies, even if they aren't among the most important, and to be familiar with a number of the regions involved, including Africa, which BRGM has worked on for decades, our experts joke that half of Africa's geology is in BRGM's vaults in Orleans. We know a lot about the subject, so we must use it to develop and secure some of our supplies. A few words in conclusion. I can't end this presentation without mentioning the work the government commissioned from Philippe Varin and the report that was submitted on January 10, 2021 which proposes means of securing our supplies of strategic metals. This was a major undertaking that took 3 months to complete, in which BRGM was of course extensively involved. It led the government to adopt a number of decisions in line with the report's recommendations, which I won't explain in great detail, but just give you a general outline. First, we must reinvest in these value chains to secure our supplies. So an investment fund for strategic metals for the energy transition is being established. As I said, we must work much more closely with all private and public parties at the international level, to secure environmentally responsible and sustainable sources that protect the environment and local populations. There is also a diplomatic strategy being developed for mineral resources. As well as an interministerial delegate, in charge of coordinating it all, to be nominated. BRGM is working on a new observatory for critical metals to identify all these supply chains, to perform simulations, test resilience, anticipate crises, etc. And a responsible mining label, a certification, will be developed. We won't be reopening old, dirty mines. The challenge today is to make clean, low-impact mines that respect local populations, but it must be guaranteed. A label, a certification, is being considered, with France playing a major role in Europe to implement this standardization at the European level. In conclusion, I would like to say... As you know, we have relied for a century on oil and gas, well first on oil, then on gas, or even coal, then oil, then gas, to be precise. We decided that, to fight climate change, we must escape from this dependence while recognizing that there will be new dependencies on mineral resources, with new geopolitical dependencies. You can clearly see them reflected in my presentation. I think that the magnitude of demand and needs should cause us pause, and it will likely be - this is my view - a potential barrier a potential hurdle for the energy transition, given the scale of needs that will have to be met. Securing supplies will be a key challenge. It is a prerequisite to reclaiming our industrial sovereignty. And these new mining activities only make sense if they are sustainable and responsible. This essential principle needs further development and R&D, as well as certification and traceability for supplies, and border controls, otherwise dumping will take place. These are the main conclusions to be drawn, thanks to BRGM's work in developing a comprehensive overview of these issues, which is ongoing and an extremely important challenge. Thank you. I was a bit long, I apologize. I leave the floor to you. I'm sure that there will be questions. Thank you. Hello. I have a very simple question, On slide number 30, you compare nuclear power to windmills and mention a ratio of 16 to 1, measured in TWh. But a windmill... If there is no wind, there are no TWh, so the ratio becomes infinite... Slide 30. Indeed, the last graph was in TWh. It takes into account the fact that onshore wind turbines only run 21% of the time on average in France. So intermittency is definitely taken into account. Or 40% offshore. Life span may not be taken into account. Obviously, a reactor that might last 80 years and a wind turbine that might last 20 or 30, that's not equivalent. I'm not sure that was accounted for. Good point. * Yes, Montville. I was quite struck by the fact that wind power production requires the use of rare earths to make permanent magnets. We've known how to generate electricity without permanent magnets for quite some time. It's rather strange to revert to ancient technology when, for at least 60-70 years, currents have been controlled with electrical circuits. I don't see why we need rare earths and permanent magnets to make wind turbines. We could easily have conventionally driven devices, such as those used for small hydraulic machines. I am not an expert on the subject, so I don't have the answer to your question. I imagine there are good reasons. I can tell you that the dependence on rare earths is driving research to try to phase them out. For onshore wind turbines, we can do without rare earths. But we continue to need them for offshore wind turbines. There is an issue of power density, but I can't go into more detail. I think it's because the major global power companies weren't involved in wind turbines in the beginning. If it had been large, well-structured groups, they may have chosen differently, but that's one argument. Perhaps, but they're all involved now. Not one is missing. If there is a solution, I trust that they will implement it. If so, it won't be long before they do. Thank you for your presentation. As a pharmacist, I have some knowledge of chemistry and I know the periodic table, starting with hydrogen. What about hydrogen power? What is its standing, compared to everything else you presented? I didn't present hydrogen because I already went on too long, but hydrogen is only an intermediary. There is a lot of activity around hydrogen. But if you're saying, "I have a power surplus, "how can I store it as hydrogen?" and then reuse that hydrogen... There are different solutions, but it can be directly reused in fuel cells to produce electricity. So it doesn't change the overall picture much, apart from specific needs for hydrogen production and for fuel cells, in particular for platinoids. This is well studied and integrated into the aggregate numbers when I said: here are all the carbon-free technologies and their requirements. That includes hydrogen. But hydrogen is only an intermediary storage medium. First of all, thank you for your presentation. I'll start by saying that I'm not a scientist and you were really able... I really enjoyed your presentation, which was very clear and very instructive. Thank you. The question I have, it's very interesting... I came here to hear a scientist talk about what I have read in Guillaume Pitron's books. And that's exactly what it was. So that means he's right and you're right. I'm not sure we can conclude that we are right! But this was exactly what he says about technology and metals... You've read both of his books! I've read both of his books, which are very interesting. My question is this: as a child, I was surrounded by the nuclear industry since my father worked at the CEA, but why do we keep pushing for wind and solar when you've shown... The graph is striking! ...that thanks in particular to nuclear power, we can do without most of the periodic table. So why do we bother? And that raises an underlying question that I would like you to address concerning the dependence on uranium for nuclear power plants. -Can I say pass? -Pardon me? -Can I say pass or not? -Yes, thanks anyway! No, no, I'll give you a serious answer, but... it's a political choice in a way, by some parties or elected officials to consider that the risks inherent in the nuclear industry outweigh its benefits. That's not my conclusion, but as citizens and as elected officials, for some, they are entitled to their point of view. But when you look into the specifics, you find that the road ahead is very complex and that... as Jean-Marc Jancovici explains, the shortest path to decarbonizing our industry and fighting climate change isn't to quit nuclear power. We agree on that. But after that... The democratic process requires that every voice may be heard followed by votes and elections and the majority prevail. But that isn't the most rational point of view. It's not a done deal. I agree. Many countries are reversing course on this issue. Let's be clear, the energy transition was initially considered at the national level, but everyone has come to the realization that implementing the same transition across all countries will lead to a resource problem. That's what the figures I gave you show. If we all want to drive electric cars, starting with 1.4 billion Chinese, we will have a problem. Even if there is a lot of lithium on earth. So at some point we have to emerge from this period where everyone thought they would do the same thing and find solutions based on each country's specificities, whether from a geographical, technological or political standpoint, etc. Good evening. I didn't see the mineral production coming from New Caledonia on your charts. Is New Caledonia considered national production? Nickel, for instance, is an important resource in New Caledonia. Unless I'm mistaken, but I'll let Isabelle correct me if I'm wrong, New Caledonia is independent in terms of mining even though it is a French territory. However, we have contracts with New Caledonia and we are deeply involved in mining activities. But it's one supplier among others. Thank you. And New Caledonia's nickel production compared to Australia's isn't on the same order of magnitude. So that's part of it. And there is cobalt present in New Caledonian ore that not all operators extract. * Yes, Christophe Loïc Martin Didier, retired from the CEA. A more long-term question: do we have any idea how fusion will fit into this strategic metals question, whether it be for lithium or coils, etc.? No, I've never seen any studies on this. The little I know of it makes me say that in terms of intensity... The amount of energy produced relative to the quantities of materials used is such that these needs are easily "absorbed" by currently available resources. So I don't anticipate any major difficulties, but I haven't done any studies on the subject. This is more of an intuition than a demonstration. * Gérard Cognet. Thank you, Christophe, for this presentation. A few years ago, there was a great deal of excitement around rare earth resources in Greenland, so much so that Trump considered buying Greenland. What is the reality? Greenland is very rich in minerals, in rare earths, but also in many other elements. However, rare earths in Greenland also contain, as in many places, uranium and thorium. This means that the materials left behind are radioactive and the government of Greenland is strongly opposed to its mining and has passed a law prohibiting the extraction of this ore due to its radioactivity. Of course, laws can change, but today, the people and the government are fiercely opposed to such mining operations. But Greenland is a very rich country. Thank you. Good evening. I had two quick questions, one directly related to your slides. On slide 37, you said that the fastest way to open a mine takes a minimum of 17 years. I wanted to know what causes this delay, mainly? My second question is more general: do you expect, in the years to come, a structural evolution in your institution's stance given the necessity of what you call diplomacy, in particular with African countries where a significant share of reserves are found? So, first, the long delay is because between saying, "this region "potentially has valuable resources", and opening a mine, there are many steps. You need to do airborne analysis, field sampling, drilling and probing. If its potential is confirmed, it still needs to be "cubed", i.e., how much will you actually extract from the ground? Not in the absolute, but at an economically viable cost, because you're not trying to bankrupt yourself. All of this, plus the necessary steps to obtain an exploration and exploitation permit, public inquiries, etc., usually take between 15 and 20 years. Except in the case of brines, for example, in South America. Since the resource is directly accessible, it's much faster. And this is without taking into account, I haven't yet seen any practical assessments, of the new mining code that was recently published and which adds local population consultation processes before any site is opened. Consultations inevitably add a certain number of months or years. Concerning BRGM's role, BRGM is the French Bureau of Geological and Mining Research, so natural resources and mining have been part of our DNA since our founding in '59. Until the late 1970s, we were a mining operator. We were a research and consulting institution and operated a number of mines. We lost this industrial dimension but we have real expertise. Today, we provide technical support to the State, both in terms of strategic vision, technological and economic oversight, and resource diplomacy, where we work alongside the Ministry of Foreign Affairs and Industry. André Lacroix. Sorry, a question and then a request. The question: you only talked about land resources. Yet there are many resources at the bottom of the sea. That's my question. And could you give us a very, very quick overview, of current uranium resources? In the past, France was in Niger, etc. Now it's much more extensive. Could you give us a quick overview of uranium resources today? Thank you. So, on deep-sea resources. I was consulted 15 days ago by the Senate on this subject. Indeed, there are resources that are not well known because we have recovered only a few samples, which is extremely limited, which are either polymetallic nodules or concretions in thermal waters that emerge in deep waters. Those are the two main typologies with concentrations of a number of relevant metals that appear interesting. I'll add two caveats to that right away. "Appear interesting" means that a sample contains quite a bit of material. However, the big question for all of the mining industry is whether it is economically attractive. Is the cost of extracting this material commensurate with the price at which I can sell it? Who can answer for the deep sea? We have 0 answers regarding that. And the second point, which is even more important, is that mining resources from the seabed will be justified once it has been demonstrated that its environmental impact is less than that of opening a mine in X, Y or Z country. And that is a long way off. We don't know how ecosystems work at 2 or 3,000 m below sea level. We don't know how they will recover. So the first challenge is the decision that the President has made, to invest in exploration. So yes, we need to understand these environments better. We have a lot to learn. Some time will pass before we can start mining, and we must demonstrate that we are capable of doing so in sustainable conditions. Having worked a lot on environmental issues, I doubt that the impact on the sea bed is any less than that of a mine in Brittany, in the Massif Central or elsewhere in Europe. This is just a reminder of the well-known NIMBY syndrome, when it's out of sight, we assume the impact is smaller. Regarding uranium resources... I forgot the second question. ...today we have significant available resources which have guaranteed us, at the current expected rate of nuclear power growth, roughly half a century or a century of autonomy. But it should immediately be made clear that... One thing I didn't insist on, is the distinction between reserve and resource. When we say we have reserves, we mean: "I can get this much material at such and such price." If the price is twice as high, I can go after much more material so my reserves increase. Reserves are highly dependent on the cost of the resource. Just like the cost of uranium. Its cost has little impact on the cost of electricity produced by nuclear power. So uranium reserves have some elasticity. If the price of uranium were to rise by a factor of 5, 6 or 7, economically viable reserves would increase without significant impact on the cost of electricity. This obviously represents a major potential for growth. But we are far from having explored every region of the world and there are many places with reserves that have not yet been identified and developed, for example in Africa or in China. So there is potential, not to mention the 4th generation and broader use of isotope 238. Good evening. First of all, thank you for your very informative and instructive presentation. You have shown us some beautiful exponential curves on expected metal consumption. You explained that supplies for many metals will become critical. Do we have any idea when peak production will be reached, as was the case with oil, an equivalent point at which extraction will become very difficult for the metals you presented? Can we assume that by 2100, since recycling doesn't work and consumption is booming there won't be enough for everyone? This is a different question because these resources do not have the same origin. Oil is organic matter that was trapped in a specific location 200 million years ago and transformed under the effects of pressure and temperature. So it's a finite resource and outside of those places where it's deposited, there is none. Mineral resources are not the same. There was nucleosynthesis after the Big Bang, a certain number of atoms was created, and they are everywhere. Any given element will have some uranium atoms. But it's insignificant. Resources are everywhere, and we are looking for places where they can be found in sufficient concentrations. So we won't see total exhaustion of resources. The real issue is that at some point you'll be spending more energy searching for these materials than you will recover from building a power plant, a solar panel or a wind turbine. In which case, you've reached the limit of what's available. And you can only hope to improve the energy efficiency of your technologies. So the issue is different here. And I don't think we can talk about... peak copper or peak whatever... It's not the same approach. Thank you. I'm struck by the number of misconceptions spread by the media in our society regarding wind turbines, etc., through the lack of information on the scarcity of metals that you just presented. Does BRGM plan to publish any articles or have a media strategy to improve this situation and improve awareness in French society? BRGM does a lot of scientific mediation, in terms of communication, either on its own behalf or for the government. I can refer you to a site that I could have mentioned called MineralInfo, a website that provides information on mineral resources which BRGM manages on behalf of the French government. We are also fairly present in the media. Hardly a day goes by without us being approached. However I do agree that we have been rather timid or shy in taking a position in a number of debates. This is something that we hope, at the executive level, with our president, to rectify in the coming years. It doesn't change with a snap of the fingers. We need to send a clearer message. Everyone is free, of course, to use this information as they see fit to contribute to the public discourse. * Joël Allard, retired from the aeronautics industry. You spoke about recycling materials and the fact that only a small portion can be recycled. I wonder about the carbon footprint of recycling. Considering that to recycle materials in the coming decades, we may still rely largely on fossil fuels, I wonder: in terms of carbon footprint, will it be positive compared to mining? This is a good question and an important factor for teams developing recycling processes. Recycling only makes sense if it has less impact than digging up primary resources from the ground. Otherwise we have a problem. And it's not just the carbon footprint, but also water consumption, chemicals and energy consumption. A really important underlying factor is the return on energy investment. These are the things we look at. But I can reassure you. For those materials and elements that have been studied, we are able to design processes that are environmentally and energetically advantageous. If I may interject, the processes used for recycling are the same as those used to extract metals or other minerals and mineral resources. We use exactly the same techniques, whether in hydrometallurgy or pyrometallurgy. So we also extract in the same way. What also matters for the carbon footprint is recovery, in order to be able to recycle the materials that everyone uses, spread throughout the technosphere. Recovering these metals will also have a CO2 cost, to transport these materials from consumers to the recycling plants. This also has a CO2 footprint. I will add one more point. This point is extremely important and it raises a question for us... When I say "us", I mean the scientists working on this issue, at BRGM or elsewhere. We will have to build usage chains. I will explain. If a chemical element is perfectly purified, no impurities remain, it will be easier to recycle than if it was an alloy with many other trace chemical elements. For trace elements, I'm not sure it would be worthwhile to go hunting for a few drops mixed in with many other things from an energy perspective. We need to think about the order in which we use materials. First, I'll use it in something concentrated to easily recycle it and once I use it in something more dilute and it costs too much to recover, that will be a final step after multiple different uses. Material use must be organized, otherwise we will run into a wall. Good evening, thank you very much for your presentation. I'd like to respond to your comment about organizing material distributions. I suppose this will have to be handled by institutions and political discourse. Do you see any institutions today that might fit? Or do these institutions need to be created and what forms might they take? Thank you. I will refrain from answering the last part, on the form it should take. However, what is clear is that we need to organize our industrial sectors and we already have tools for that, even if they aren't perfect. I am thinking of the Strategic Sector Committees for a number of major sectors which are there to coordinate the different industrial actors on an objective, e.g., aeronautics or the automobile industry, and which work quite well. Our analysis in the Varin report submitted to the government on the fragility of industrial sectors relied on these strategic committees which help organize and structure activities. Will they be capable of structuring value chains? I don't know. I think the market will probably control this because materials will be priced according to their level of purity or dispersion, and this could spontaneously shape their use in one direction and then another. So it will be a mix of regulations via institutions and material costs that will vary. Hello, Salomé Queffeulou from the CEA RVE in Marcoule. I have been working on Lithium-Ion battery recycling for 4 years and I first want to thank you for this presentation. It shows the importance of recycling even if it is only a small part of the solution. But it also gives meaning to the work I can do as well as my colleagues. But it's true that we... To speak more emotionally, we... You need to give a little hope, let's say, because... seeing all of this, we're a little... It's depressing. If I may respond to that comment, if the message you're getting... Well, I'd like to correct the message I sent. No, it was saying the right thing, but if you step back and look at the big picture, you... Sorry, I'm a very emotional person. I'll calm down but... I am passionate about my job and looking at all this, you think: "My God, where are we going?" But I'll keep working, don't worry! And try to find solutions, of course. But it's true that it's a bit scary. Maybe... There are several things here. I understand that the complexity of these issues can be frightening. That is to say, we must eliminate once and for all the simple solutions and those who try to promote them. There is no such thing. We are dealing with a complex world and we are facing a situation where all solutions are welcome. And we really have no right to ignore them if they address the issue of climate change and the greenhouse effect. Obviously, recycling is extremely important. It's part of the solution, but not the entire answer. That's an important point. The second point is that we must move forward and improve our energy efficiency. There is probably some energy sobriety that may flatten the curves more than what I have shown. There is one point that I did not go into in sufficient detail, which came out in a decision taken after the Varin report: technology is evolving very quickly. You can see it with batteries, I imagine you're following this, but also with engines and many other things. So this analysis is based on today's technologies. If you do this presentation in 5 or 10 years, you will have a different point of view since technology is improving rapidly. I'm not saying that technology will solve everything and that it's not worth trying. But it is part of the solution. That is to say... For example, up until recently, batteries were made with NMC cathodes, nickel manganese cobalt. Today, major countries such as China are switching and saying that for certain uses, lithium iron phosphate cathodes would be better. So they need less cobalt, nickel, etc. That changes all my graphics. Because we're learning on the move, we're facing new problems, so we're realizing that... We need to move away from simple, one-size-fits-all solutions. We try to apply the same technologies and solutions for a bunch of different problems but we have to customize them. We won't have the same batteries for a city car that travels a few km per day and a long distance vehicle, a truck or a bus. We're just starting to absorb that and it will help broaden the scope of possibilities and also to reduce, I would say, the size of the mountains we must collectively climb. Thank you, my apologies.

"Subsurface challenges in the 21st century" conference – Securing the supply of strategic mineral resources

Transcription

Thanks everyone for returning to your seats in this magnificent hall at the Collège de France. We're about to start the second round table, and I invite the speakers to take to the stage. This round table will be led by Myrtille Delamarche, Editor-in-Chief of the Raw Materials Factory, I think I'm correct in saying that. Sit wherever you like. We'll put your names in front of you, wherever you sit. I'm going to... I'll let them have a glass of water first, as it's good to lubricate your throat before speaking. I'm going to leave... We'll put the names of the speakers in front of them. Maybe we'll display the title of the round table. This second round table will open with a theme that is so important for the BRGM, which is that of resources and securing the provision of strategic mineral resources. In this discussion, chaired by Myrtille Delamarche, we'll hear different points of view, subjects and opinions. And now without further ado, I'll hand over to Myrtille Delamarche.

For this second round table, my role is to keep you awake. We'll talk about securing the provision of strategic mineral resources. I must confess that, as a specialised journalist, I'm seeing various sources, all of which are very reliable, that carry varying projections regarding our need for resources in the future and our ability to obtain those resources. I read in the renowned French Mining Industry Review that by 2025, we need to increase the worldwide production of dysprosium by 664%, of cobalt by 34,900%... I'm serious. That the UK alone, to electrify 100% of its cars, would need twice the current worldwide production of cobalt, all of the neodymium, 3/4 of the lithium worldwide... In short, lots of alarming projections. I'd like to know from the panel how they feel about these materials and their solutions for overcoming those risks. I'd like to welcome Victoire de Margerie, co-founder and Vice-President of the World Materials Forum. Hello. Philippe Chalmin, Professor of Economic History at the University of Paris-Dauphine, founder of the Cercle Cyclope. Hello. Paolo De Sa, extractive-industries consultant, and former head of mines and energies at the World Bank. And Christian Polak, an expert in rare earths and strategic minerals, senior advisor to the department of strategy and business development for Orano Mining. He is also chairman of the School of Geology in Nancy.

Hello.

And for the BRGM, Pierre Toulhoat, Deputy Managing Director.

Hello.

As I said, there are many evaluations of the criticality of metals and minerals. For whom are the metals critical and strategic? And based on what criteria? Paolo De Sa, I think you have some excerpts from a study by the World Bank.

That's right. Thank you. Hello, everyone. Congratulations to the BRGM on its anniversary and thanks for inviting me. I headed the mines and hydrocarbons group of the World Bank for many years. Recently, in 2017, the group published predictions on the growth in demand for certain minerals that will be increasingly used in certain growth industries. This study mainly covers renewable energies, wind and solar especially, the automobile industry and energy storage. The figures, the results of the projections from the World Bank study, as you can see, are astonishing, with lithium as the prime ingredient for batteries... and justifying the craze for the development of lithium deposits, whether by evaporation in Latin America, the famous triangle of Bolivia, Argentina and Chile, or a hard rock in Australia... Cobalt, for which the world depends, unfortunately, on countries whose political stability is not that strong, especially the DR Congo, and to a lesser degree Zambia, and certain materials known as rare earths. I should also point out that even for more conventional products such as copper, World Bank projections see a growth of around 7% by 2050. For these industries overall, this poses major problems in terms of the development of new deposits that could meet that growth. Many of the copper deposits now being mined are old. Many closures are planned in the years ahead, in Chile and other countries. So mining companies are rushing to exploit known copper deposits especially in Latin America, but there is also Australia, which is desperately seeking another mega-deposit of copper to boost its mining industry in that way. So there's a lot of uncertainty, as you'll have seen from these projections. At the first round table we spoke about the climatic upheaval, the digital upheaval. As an economist, I prefer to concentrate on the industrial upheaval, the industrial revolution 4.0 that has started, which will greatly change the production methods and the metals required by the new industries, if I may say that, but also the commercial upheaval. We are living in a period of commercial wars breaking out all over, which are in danger of calling into question the model of economic development of the last 20 years based on exchange and globalisation. Until recently, we thought that China would produce everything, that it would be the world's factory and that all other countries would stop producing. The United States are calling this idea drastically into question. They are asking companies to repatriate a large part of their industrial production using subsidies, domestic investment and export tariffs, thereby disrupting international trade and the international trade order based on the World Trade Organisation. So the question is, who will be the new world factory? Which country will occupy that position? It certainly won't be China alone, but we don't know who is coming over the horizon, and what kind of supply policy these new industrial powers will have. The second slide is already there. The US, faced with this uncertainty, has already undertaken an initiative for securing the provision of raw materials, which they call the Initiative on the Governance of Energy Resources, whose apparent objective is to reduce the dominance of China over manufacturing in growth industries and the supply and therefore the consumption of those so-called strategic materials. So the US has labelled 35 substances as strategic, which is a relic of the past. They have had such a list since the 1960s. There were lists of strategic materials. They haven't removed any, but have added new products. But what is interesting, and we'll talk about this later, is that the strategy of the US unlike that of the EU, for example, is based on the development of gold, essentially on a policy of facilitating foreign investments in mining, in production, the discovery and development of new mining deposits. The countries who have rallied to this US initiative are mainly those with a strong mining potential who hope to benefit from it and see a major growth in their investments in the mining industry.

Thank you. Pierre Toulhoat, as part of the World Materials Forum, the BRGM and a host of other partners undertook another kind of evaluation of the criticality of materials for industry. Can you talk about that?

First of all, I'd like to say that criticality is a concept that combines the strength of demand, the ability to supply that demand and the strategic issues associated with the various minerals concerned. The BRGM regularly works for the ministries in charge to evaluate and produce criticality figures. More recently, we have, as part of the World Materials Forum, at the behest of Victoire, tried to provide criticality evaluations that are not specific to one country, government or continent, but which can be used by industrial players together, while targeting major markets and users. We've produced a simple methodology. Many teams work on criticality and produce algorithms and extremely complex formulae. We wanted to be simple and pragmatic. Based on the six criteria that you see here... Sorry, the previous slide. The number of years of reserves, based on the incontrovertible data from our colleagues at the USGS, the US equivalent of the BRGM. The uncertainty of supply. The degree of political exposure in the zone where the mineral in question is produced. A qualitative assessment of recyclability. Certain metals can be easily recycled. Others, such as rare earths, are recyclable at no more than 1%. Questions linked to the uncertainty of demand, with many variations and technologies that are still unstable. The very fast technological evolution is extremely important in these criticality studies. And lastly, the vulnerability in a certain number of key sectors. What happens if supply is suddenly interrupted? With our colleagues at CRU and McKinsey, and of course those at the BRGM, who are highly motivated in their work, we have mapped this criticality based on the periodic table of elements. In red, obviously, are the metals deemed the most critical in terms of the criteria that I just outlined. Clearly, it covers what Paolo De Sa just told us. It has the same ingredients, with metals linked to the energy transition. And you can see an example. Cobalt appears with a very high criticality because it is more exposed politically than lithium. Lithium is relatively common in the earth's crust. You have to find it, but there is a lot of it in hard rock, on old shields. We can see the three rare earths most used in the energy transition, for electronics in general. Then we've seen the appearance of tungsten which is in bright red, and which has many uses that are changing, especially in high technologies. Also more unexpected metals such as tin. Last year we saw zinc. The situation has improved, but tin, for example, is a very sought-after metal and will continue to be so. Since we started this work, we've been studying how things evolve each year. I think Victoire can comment on our progress, how this system of criticality is seen in a dynamic way, and what value is put on the efforts of manufacturers to adapt and countries to adjust their policies.

Before we get to the solutions, I'd like to mention another risk because other than the criticality which is variable, there is another factor which is price volatility. Philippe Chalmin, can you tell us about how the different metal prices are determined?