Extract from the interview published in the Géosciences journal No. 26: "Critical metals, can ethics and sovereignty be reconciled?"

By 2035, all the new vehicles registered on the market should be zero-emission. This means that no more vehicles with internal combustion engines will come off the production line. It really will be the end of an era.

Patrick Pélata: Yes indeed. Companies that only manufacture combustion engines will disappear or have to find other outlets. We need to understand that the scale of the transition that lies ahead is huge and that it will involve a real paradigm shift. However, other sectors will also develop, through innovation and technological advances. Localising the production of batteries is one of the key challenges we face in the short term.

Localising production also requires securing supplies. Does this mean the issue of localisation will also affect the supply chain?

P. P.: Absolutely. Manufacturers are trying to sign medium- or long-term contracts with mining groups. However, between the mines and the battery factories, there is another key step, namely refining. Nickel has to be completely purified to be transformed into nickel sulphate, which is then mixed with other powders to obtain a homogeneous mixture, without which you can't make batteries. Refining is a specialised industry, and we need to set it up right here in France. Even though Europe has seen an increase in terms of battery factories, it is still lagging behind as regards the refining stage of the value chain.

So, we need to develop new industrial expertise in France and Europe. A hub is currently being set up in the Hauts-de-France region. Can you tell us more about that?

P. P.: France aims to open a hub in Dunkirk. This ecosystem will cover the entire production chain: hydrometallurgy, electrometallurgy, powder chemistry, etc. Two gigafactories are already being set up in the Hauts-de-France region. One is the Automotive Cells Company (ACC) plant in Douvrin, which is a joint venture between the TotalEnergies Group and Stellentis. The other is Envision AESC, a pioneering Japanese company in the battery manufacturing sector, located in Douai, just next to the Renault factory. And the same thing is happening all over Europe. Factories are already up and running in Poland and the Czech Republic, while Germany and Sweden are now starting production and further projects are in the pipeline in Norway and Hungary.

The demand for metals is increasing and will increase significantly in the future. What can you tell us about the situation in terms of production and the raw-material reserves available?

P. P.: There is currently no pressure in terms of the cost and production of manganese. There is plenty of it and the world's second largest producer is a French mining company, Eramet. There are also significant reserves of lithium, and while production capacity is not yet sufficient, it is growing steadily. However, as regards the demand for nickel and cobalt, the world's reserves and production capacities need to be analysed. If the targets set by the European Commission are met, cobalt reserves should not reach critical levels. Moreover, a lot of research is being conducted into making batteries with a lower cobalt content. The real problem is nickel, because the majority of world production is used in steel alloys, which consume a lot of nickel. So, we will need to open new nickel mines. Currently, the largest and most recent mines belong to Chinese companies, especially in Indonesia. Even though there are also mines in New Caledonia, Canada, Finland and Russia, we face major geopolitical challenges concerning nickel.

What are we lacking in order to move towards industrial-scale recycling in France?

P. P.: First of all, we need to be aware that there are three main stages in recycling. You need a network devoted to collecting and recovering batteries, since car manufacturers cannot do this alone. This is why Renault has joined forces with Veolia, for example. Then, the batteries have to be dismantled to recover the cells that are in good condition and integrate them into new batteries. Cells whose storage capacity has deteriorated too much will have to be recycled. However, to do this, we will need large recycling centres that are capable of processing the cells. I think that in the long term there will be two or three in France, in which nickel, cobalt, lithium and, possibly, graphite will be separated. These raw materials will then be reintegrated into the refining stage and be sent to the powder-production and battery-assembly plants. Four French groups are currently working on these innovative projects.

Geosciences no. 26: Critical metals, can ethics and sovereignty be reconciled?

Issue 26 of the Géosciences journal, published in June 2022, focuses on the topic of critical metals.

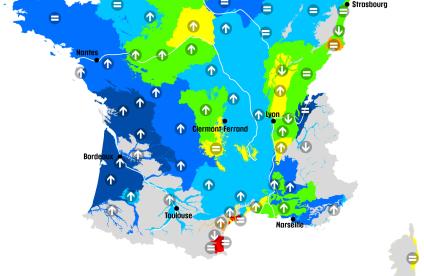

The energy transition towards carbon-free production reveals more than ever how dependant our technologies are on an increasing amount and variety of metals. Will we be able to meet all the needs for mineral raw materials in the coming decades? How can we secure our supplies given that the last mines in France closed at the end of the last century?

BRGM, France's leading public player in the field of mineral resources, has devoted this issue of its journal, Géosciences, to answering these questions and many others.

This issue, which includes an article by Philippe Varin, author of the recent report on securing the supply of mineral raw materials to industry, and an interview with Christel Bories, CEO of Eramet, discussing the place of metals in our daily lives, takes stock of European mining potential and reviews the state of recycling in France and the prospects for innovation in this field.